Trading strategies

In this part of the module, we will go through some time-tested algorithmic trading strategies employed by successful traders. These setups can be combined with other rules & fine-tuned as per the trader's ease. Let us begin:

1) Momentum/ Trend-following strategies

The premise behind this idea is straightforward- Jump onto the bandwagon as soon as the ball starts rolling. Put it another way, stocks that go up are likely to go up further & stocks going down will likely continue their downward trajectory. Momentum-based algorithms simply follow the direction of the stock as soon as there is a spike in volatility. The algorithm is further supported by the use of technical indicators such as moving averages, channel breakouts, time-series data points, etc. Momentum investing strategies have generally been known to outperform the index by a huge quantum. Open-Range Breakout (ORB) is another momentum strategy employed by day traders with a short-term view.

2) Mean Reversion strategies

It best suits those stocks that have been range-bound over some time. The algorithm generates sell orders when the stock reaches the upper end of the band & buy orders when the stock is near its support or the lower end of the band. The general concept behind this idea is that asset prices return to their mean value periodically. For instance, the stock price of Reliance Industries moved in a narrow channel of 15% for a period of more than 7 years between 2009-2016. A trader would have made a fortune by applying such a tactic on the stock of Reliance Industries. It is a sign of an astute trader to change a mean reversion strategy into a momentum play once the stock breaks out of its range.

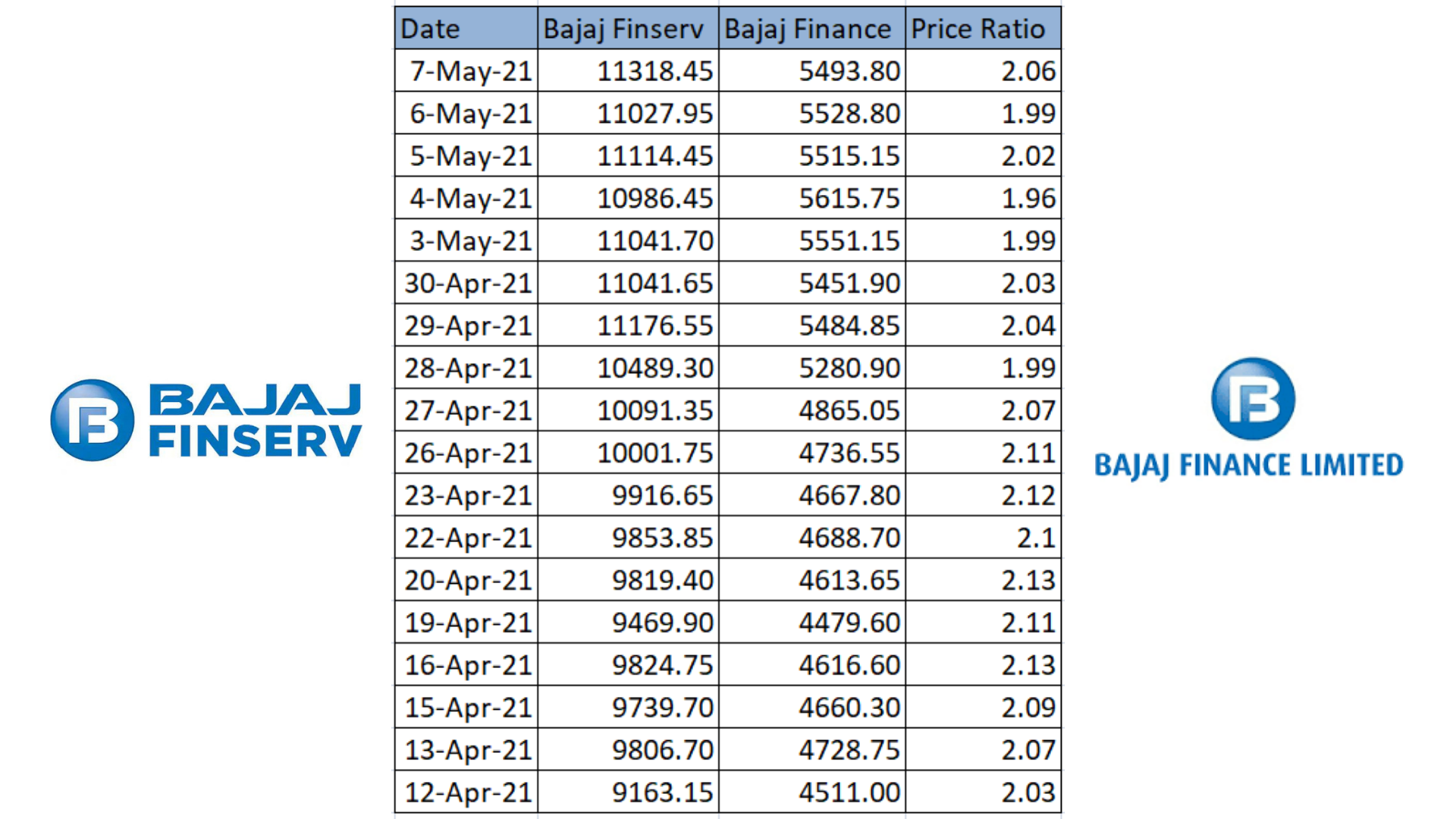

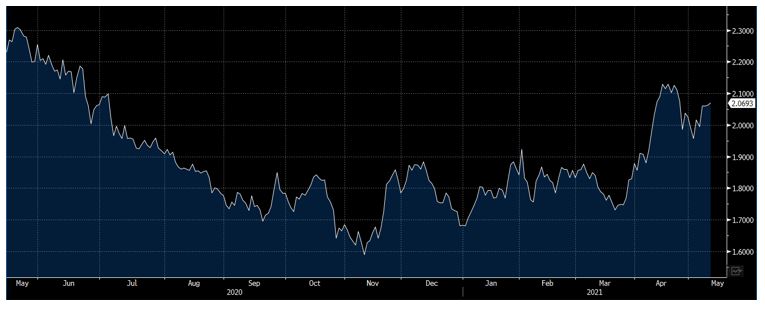

Pair/Spread trading is another widely used mean-reversion strategy. It might be used on two highly-correlated securities viz the likes of Bajaj Finance & Bajaj Finserv.

Look at the below chart of Bajaj Finance (blue line) and Bajaj Finserv (orange line):

The above chart goes on to show that price movements of both the stocks are highly in sync with each other.

Stocks operating in the same sector such as Bajaj Auto and TVS Motors or ACC & Ambuja Cement are also good proxies to play this trade. Additionally, one can also inhibit index values in the trade. For instance, if a trader expects the stock of State Bank of India to outperform the market, he may go long on it and simultaneously short the Bank Nifty.

The next logical thing to do after shortlisting a trading pair is to work out the historical spread or price ratio between the two.

Historical closing prices can be obtained from the NSE website.

This is just a sample dataset but the same must be done for at least a year to check the upper and lower band of the ratio. As observed from the data, the price ratio oscillated in a range of 1.6-2.13 during this time period, both depicted in the table as well as the chart.

The opportunity for a trade arises when the ratio reaches close to the upper or the lower end of the band i.e., sell at the top and buy at the bottom.

This was an overly simplistic depiction of the analogy behind pair trading. Other complex statistical arbitrage tools such as mean, standard deviation, maximum & minimum deviation from the mean, Adf test stats, Adf critical values, p-values, and so on are used in conjunction on this dataset.

3) Sentiment strategies

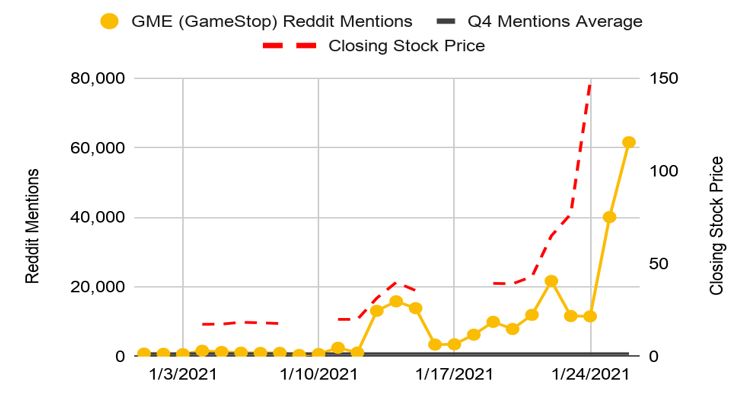

Sentiment-based analysis is another emerging & powerful tool that traders can utilize to stay ahead of the curve. Such algorithms are based on the perception of other market participants and where they expect asset prices to head. Every asset is alloted a sentiment score based on which the quantity to be traded is decided. The data for such algorithms might constitute Google search trends, Reddit posts, Twitter mentions, brokerage reports, FII data, Put Call Ratios and others. Studies have also shown that there is a high correlation between investors' information gathering on social media & market participants' trading decisions.

Another example of sentiment strategies can be those algorithms that generate bullish/bearish signals in anticipation of Mutual funds/HNI buying/selling. Aptly quoted, Artificial Intelligence is the future.

The Gamestop (NYSE:GME) Saga in the United States is a timeless example of how sentiment strategies can be used to spot once-in-a lifetime trades.

Social media buzz around the GME stock had started picking up days before the stock exploded by 2500% in a single month.

4) Market-making

Market-making or jobbing is a type of HFT that involves buying & selling securities continuously within a short span of time. By doing so, they provide liquidity to the markets & are hence rewarded for their inventory risk by bagging the bid-ask spreads. Back in the day, jobbing was mostly done by humans but these days it's almost entirely automated. Some market makers also take overnight positions i.e., carry long & short positions on a diverse basket of stocks indefinitely. Agility, high-quality data & low-latency infrastructure are the troikas of an eminent market-maker.

Scalping aka scalp trading is another fast-paced strategy that can be used to capture small price movements. Scalpers depend largely on technical analysis & use a number of indicators such as RSI, Stochastics, Bollinger Bands, etc to hunt potential trades. Herein, positions are held for a matter of seconds or minutes instead of hours/days. High winning ratio is critical for a scalper as they exit as soon as the position reaches a target profit percentage.

5) Arbitrage strategies

They involve buying & selling of the same security on different exchanges with a view to make a riskless profit on account of pricing inefficiencies. The stock is bought on the exchange that gives a lower price quote & sold on the one with the higher price. The existence of arbitrageurs eliminates the mispricing thereby establishing equilibrium again. Such opportunities are difficult to spot with the naked eye and can only be identified by leveraging algorithms. With that being said, the average annual returns earned via these strategies is not lucrative enough & is more or less equivalent to those earned by liquid funds.

6) Weighted average price strategies

Strategies such as Time Weighted Average Price (TWAP) or Volume Weighted Average Price (VWAP) can be used for filling up large orders at favorable prices. Case in point, ABC Mutual Funds wants to offload 10,00 shares of XYZ Corporation. He can simply employ a TWAP algorithm so that the order gets traded in small slices at regular intervals throughout the day. Similarly, the trader might use a VWAP algorithm to execute the trade close to the desired price.

7) Machine Learning-Based

Artificial Intelligence is the new buzzword in quantitative finance. Instead of hard-bound rules, Machine Learning algorithms allow a system to observe what’s happening in the environment and incorporate new data from the market into the decision-making process. There are umpteen trading strategies that can be deployed in this segment.