Stock Investment Ideas

Now that we have a complete understanding of financial statements. Let us learn a few simple steps to generate stock investing ideas.

What are the few simple ways to generate Stock Investment ideas?

This is one of the most searched topics in the investment world. Out of thousands of companies listed on the exchange, it becomes very difficult for anyone to conduct research and decide in which companies to invest. Knowing the basics of the stock market is the first step to being able to invest in the stock market.

Let’s make it simple for you-

a. You may start with Nifty 200 list of companies

b. Chuck out companies which are outside your circle of competence. Don’t worry if you chuck out a lot of companies in this process.

How to generate stock investment ideas?

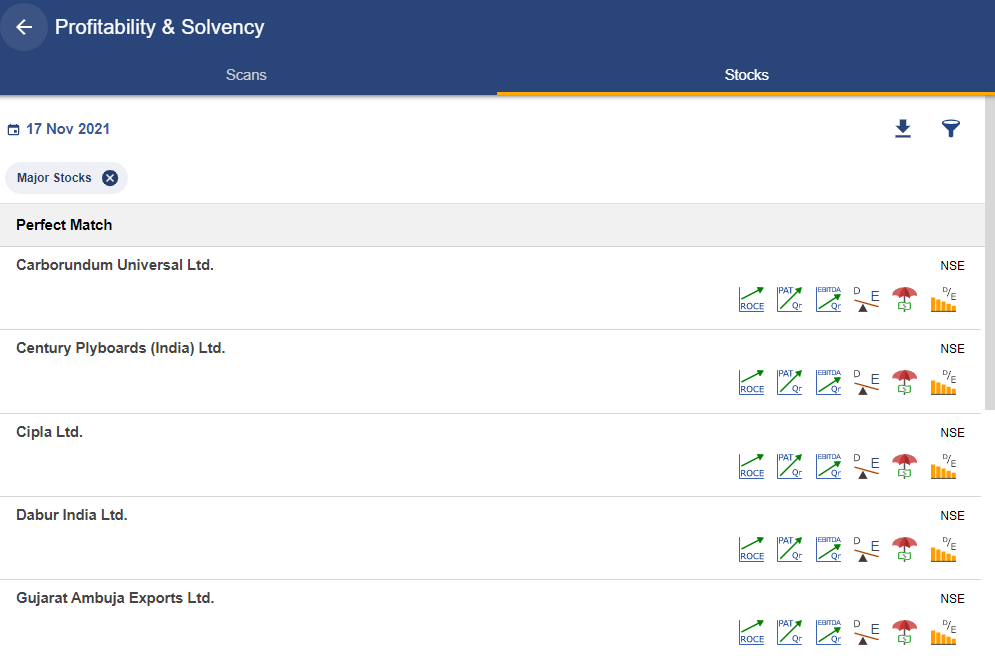

1. Stock scans and screeners

Using proper screeners and scans can filter the stocks which suits your investment decision making process.

You can use the StockEdge App and create fundamental scans of your choice.

Suppose you want to screen stocks with improved profitability and solvency.

We have chosen six scan parameters, belonging to the above segment, to find companies having:

- Improved Return on Capital Employed

- Quarterly Net Profit Growth YoY

- Quarterly EBITDA Growth YoY

- Low Leverage

- High Interest Coverage Ratio

- Consistently Decreasing Leverage

This will provide you with the list of all stocks that conform to the set scan parameters of improving profitability along with strong financial risk profile, using which you can determine the best investment option.

You can follow a step-by-step instruction on how to create a fundamental scan by Clicking here.

2. Disgraced stocks (52-week low list)

Most people have a tendency to avoid disgraced stocks but the contrarian minds always look for beaten-down stocks to find value.

Never take cues from the stock price, rather look for strong businesses which have corrected much from its highs.

Before entering into such stocks always question whether fall in such stocks is permanent or temporary?

3. General Observations

Seek ideas from things you use in daily life or see around yourself.

Do research on the companies whose product or service you like the most.

It’s not that you need to be very intelligent to invest in the stock market, rather you should keep your eyes and ear open to find good business ideas from the things around you.

“Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it”

- Peter Lynch

4. Business Media

It is not at all a wise idea to invest your hard-earned money based on tips and stock ideas provided by media houses. In most cases, these tips are made to favour vested interests and you may end up losing a significant chunk of your capital.

5. Blogs

There is an ample number of articles and blogs available which you can take as a base to start your own research work. Instead of blindly believing in what the author believes in, conduct your own due diligence.

6. Read Annual Report of companies

Flipping through countless pages of corporate trivia may seem to be a mundane task at first. However, the potential of this method to find stock ideas can surprise you.

In the annual report, the company’s management discusses the important aspects of the company like industry performance, its vision for the long term, opportunities and threats faced by the company, the company’s historical performance etc.

Check out the annual report of Marico India here -

Performance at a glance:

Financial analysis of Marico India as per FY 20-21 annual report:

Key Pointers from the annual report:

Moat: The domestic business quickly bounced back in the following quarters to exceed pre-COVID levels as more than 90% of our portfolio comprises daily-use items under the aegis of strong market leader brands. We witnessed robust growth across each of our core portfolios of Coconut Oil, Saffola Edible Oils, Value Added Hair Oils, and Saffola Oats.

Performance: Despite covid lockdowns last year, Marico's revenue increased by 10% & delivered a 23% CAGR return on PAT since its inception.

Good initiative: During the ongoing pandemic, your Company has been able to distribute 1.4 Million masks, 6.7 Lakhs PPE kits, and 633 ventilators to help safeguard the lives of primary healthcare workers, the police, and emergency services staff, among others.

International presence: Marico's business is spread over more than 25 countries worldwide & has a market share of 23% in FMCG business globally.

Award & recognition: Ranked 6th among India's most Sustainable Companies with an A+ rating – BusinessWorld and Sustain Labs Paris.

6 simple ways to generate stock investment ideas: