Expenses Matter

At 1% or more brokerage per transaction and due to frequent churn, Mr. Talwar ended up paying almost 7% per annum of the stock portfolio as commissions.

In ULIPs, Mr. Talwar ended up paying 60% of his first year premium as fees. Such a high fee significantly reduces the principal left for actual investments. This is like starting a run chase in a one-day cricket match with 4 wickets down. Obviously, the impact is huge because of the complexity of this multi-decadal product.

There are three types of expenses which we should consider:

1.Transaction brokerage fees paid every time there is a transaction that adds up to a big amount. It becomes bigger when frequent trading takes place. It comes to approx. 5% of the portfolio amount.

2.Annual fees are applicable typically in mutual funds and PMS fund managers. They charge annual fees for their service and alongside managers are also entitled to profit sharing.

3. Hidden fees are there in insurance and structured products. Investors are unable to figure out these charges easily. Investors could simply calculate the return on its principal, which would be the net returns he would get.

Expenses have been a blind spot for investors who have unfortunately focused on gross returns. Brokers and intermediaries have created different ways to skim investors.

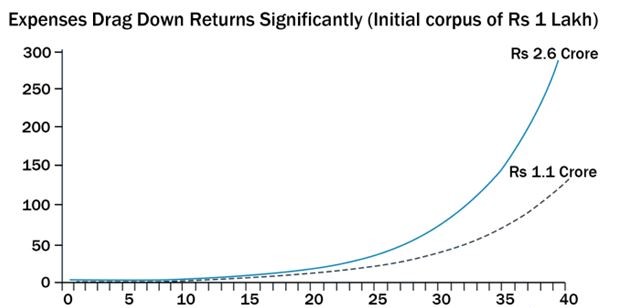

Fund expenses compounds too!

Comparing two portfolios both with 15 % return and expense ratio 2.5 per cent and 0.01% per annum. ₹1,00,000 invested in both the portfolios after 40 years will be ₹ 1.11 crore in portfolio A and ₹2.5 crore in portfolio B

Presently, most equity Mutual Funds have an annual management fees of 2.5 % . In an ETF, the fee is approximately 0.1%.

Past, present and future

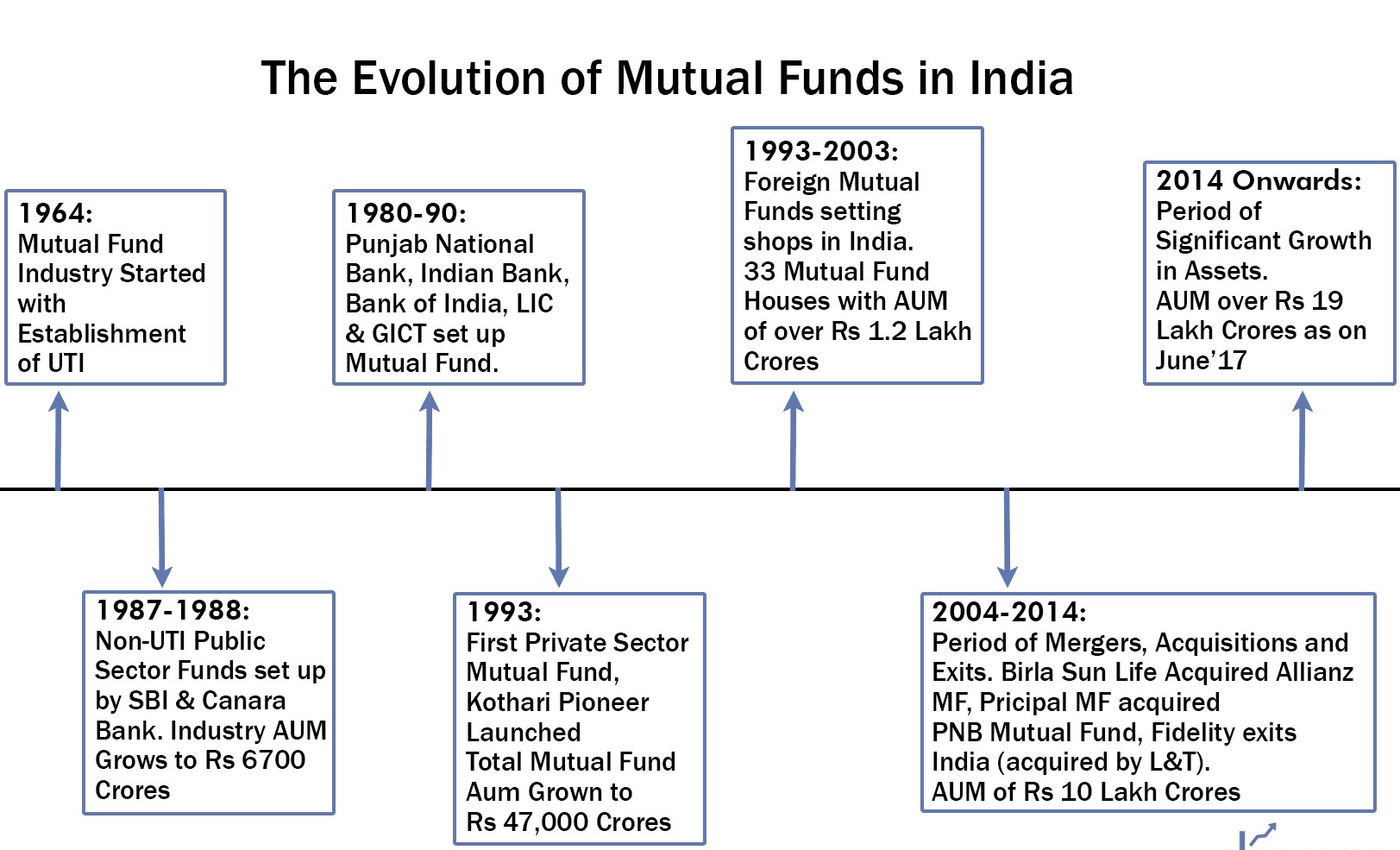

Mutual fund industry started in 1963 when UTI was formed. Initially, all fund managers outperformed the index. However, with the rising competition and greater regulatory oversight, it has become much more difficult for managers to outperform the index and this in turn, squeezes profit margins for the mutual funds. NAV Mutual Funds have brought modern technology to the forefront and enterprising fund houses have started using algorithms to run funds at a very low cost.

Why have expenses remained high in India?

Fund managers were able to generate extremely handsome returns due to the Bull market run of the Indian stock market, hence the clients could afford the high expenses. Distributor brokers sell mutual fund schemes to the Indian investor and get commissions from fund houses in return.They also charge annual fees and upfront fees. The biggest distributors are banks -both Indian banks and MNCs.

Over time, a second category of mutual funds with lower expenses have emerged called passive funds.