Bonus Issue

In Unit 2 of this module, we have learned that bonus issues are a way to distribute dividends by the companies to their shareholders. Therefore, let us elaborate on the concept in this section.

What is a bonus issue?

A bonus issue, also known as capitalization issue, is where the company offers additional shares to the existing shareholders without any consideration. The free shares are issued in proportion to their existing shareholding in the company and in the ratio decided by the company.

For example, in a 1:2 bonus issue an existing shareholder is eligible to receive one extra share for every two shares of the company held by him on the record date. In case a person holds an odd number of shares, the difference is cash-settled .

A bonus issue signifies no fundamental change in the company; neither does it make it a lucrative investment since the stock price is expected to go down in a similar proportion. The company simply capitalizes its general reserves (retained earnings). Thus, there is no net effect on the company.

Issuing bonus shares increases the number of shares which leads to a decrease in the stock price of the company in proportion to the bonus ratio. It makes the stock attractive to retail investors who hesitate to invest in high priced companies.

As an illustration, let us assume that ABC Corporation has 1000 outstanding equity shares. It announced a 1:1 bonus issue, when the market price of its stock was ₹1000. After the bonus issue, the stock is expected to go down to ₹500. Meanwhile, the number of total outstanding shares will double to 200.

Usually, a company announces a bonus issue as a means of rewarding its shareholders. A bonus is also viewed as a stock dividend where the cost for the company is less than the cost incurred in giving a cash dividend.

The face value of the stock remains the same in a bonus issue unlike a stock split and hence the only way the investor can make gains is if the dividend per share remains the same as-the previous year after the share goes ex-bonus

Issuing a bonus is just like cutting a cake into smaller portions. The total size of the cake does not change no matter how many times you cut it.

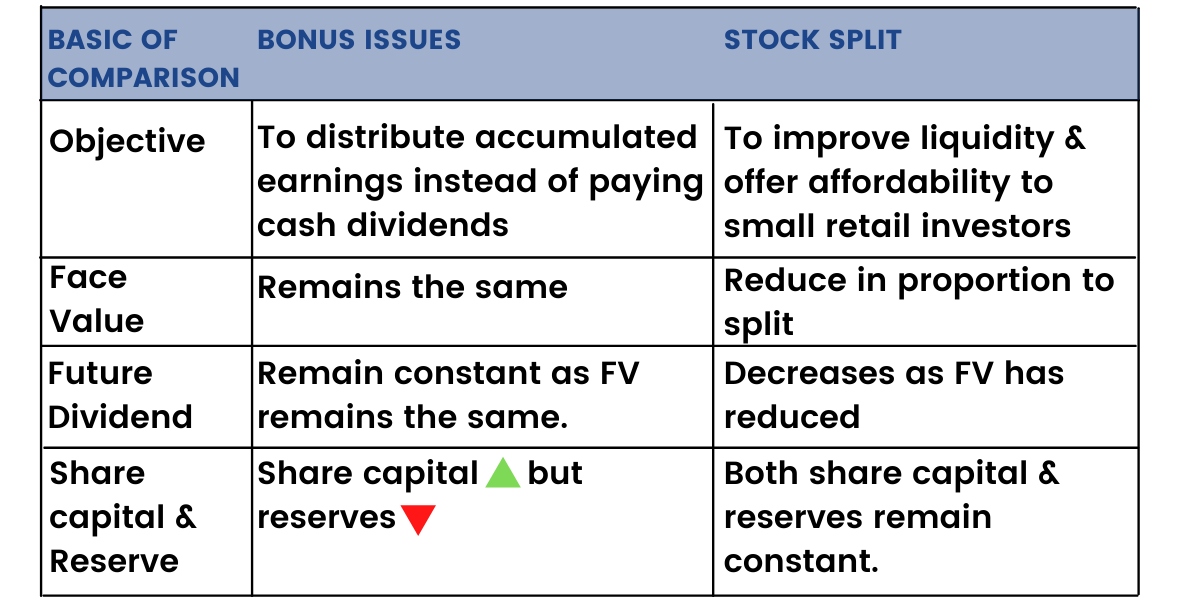

Bonus Issue Vs Stock Split