Step 6- Dividend Payments

The next sensible step after evaluating the focus on share price is dividend payments.

Investors must think of dividend payments as the coupon payments on a bond. Practically speaking, a stock is a bond with a coupon rate equal to its dividend yield.

Dividend-paying companies tend to attract investors who are looking for a regular source of income. High-dividend paying stocks such as Coal India, ONGC, Oil India, etc are revered by Conservative investors who have a low-risk appetite & prefer safety of capital over its growth. Generally speaking, Public Sector Enterprises (PSEs) have the highest dividend yields owing to the fact that the Government of India is the major stakeholder in all these companies. Dividend receipts are a huge source of funds for welfare programs run by the Central Government. As per a CAG Report, the Government received ₹36,709 crores as dividends from more than 100 PSUs. in FY 2018-19.

It is often seen that growth companies tend to forego dividends & use the retained profits for additional investment. On the other hand, matured companies with a long track record of navigating market cycles are known for paying healthy dividends.

A lot of investors tend to think that high-dividend paying companies are an indication of shareholder-friendly management. However, this may not always be the case. It is essential to check a few things before firming up a belief about the management. High dividend payments might be a signal that the demand for the company's products has saturated. Due to the lack of demand, the company does not want to invest further in the business & concludes that dividends are a prudent way of allocating the excess cash on the company's books. Companies with more or less flattish revenues & fluctuating profits do not command high valuations. This is why so many legacy companies are constantly on the fray to remain relevant by diversifying their revenue streams.

The management must make some tough calls on dividend payout if the company is struggling as the earnings might not be enough to distribute. Such news is perceived very negatively by the markets & leads to huge sell-ofs as sticky investors tend to look for other sources of passive income. For instance, Royal Dutch Shell, a global energy giant with a market cap in excess of $100 billion slashed its dividend payments in 2020 for the first time since World War II with a view to conserve cash on account of the pandemic-induced slowdown in Oil demand. The stock slumped 8.2% on this newsbreak.

As battered as the earnings profile may look, some companies lack the courage to cut dividends due to the pressure of the promoter group. Public reputation is also at stake for high-dividend paying companies as markets might suggest a signal that all's not well within the company. In order to avoid these situations, the management might engage in financial shenanigans & continue with regular dividend payments to conceal the actual state of affairs.

It is crucial for Investors to assess that a company is paying dividends from it's free cash flow(FCF).

The FCF can be computed by subtracting the Capital Expenditure(CAPEX) done by the company from it's Cash Flow from Operations (CFO):

FCF= CFO-Capex

If a company does not have sufficient Free Cash Flow available after accounting for CAPEX requirements from its operating cash flows, then it is highly probable that the company is paying out dividends to its shareholders by raising debt from lenders.

Investors would acknowledge that if a company consistently goes on paying dividend by raising debt, then inevitably the debt would reach gigantesque levels & the company would find it too difficult to provide for interest payments.Hence, this practice is unsustainable on a long-term basis.

There is no hypothetical limit to the amount of dividend a company can pay to its shareholders, be it ₹1 or ₹100 per share. The only pain-point for the management is to find a lender who can furnish these loans. The operating efficiency of such companies simply does not come into question for such management to pay dividends to its shareholders.

Investors must not draw any cheer from regular dividend payments by a company that uses debt for its payout. Often, debt-funded dividend payments are to benefit the promoter group at the cost of the company & consequently at the cost of minority shareholders. A paltry dividend yield of 1% might be an insignificant amount for a small shareholder but the same might amount to crores for the promoter entity/ majority shareholder.

Let us look at a company that is paying dividends from debt proceeds:

Analysis of Vedanta Ltd

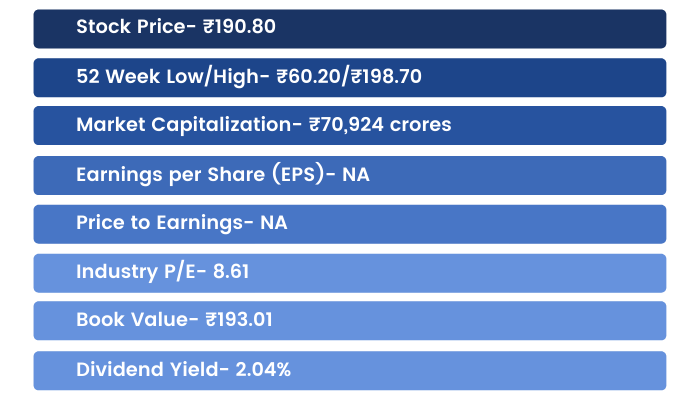

Quick Snapshot:

(Data as of Closing Prices on 20th February, 2021)

The Cash Flow from operations (CFO) of Vedanta for 9 years (FY 2012-20) stood at ₹1,32,284 crores whereas it did Capital expenditure (CAPEX) of about ₹1,43,430 crores over the same period. The financials from FY14 onwards includes numbers of Cairn India as well. The move to acquire Cairn India was seen as an attempt by Vedanta to consolidate its position as one of the world's largest diversified natural resources conglomerates by diversifying into the Oil & Gas sector.

The net result was that over the 9 years (FY 2012-20), Vedanta Ltd had a negative free cash flow (FCF) of ₹11,147 crores. However, it kept on paying dividends year after year & shelled out about ₹49,128 crores cumulatively in 9 years.

It is clearly visible that the company did not have the cash resources to pay dividends to its shareholders. As anticipated, the dividend payments were made via raising debt which in turn ballooned the debt from ₹3,741 crores in FY2012 to ₹59,187 crores in FY20.

Investors should avoid risking their capital in such companies unless the debt is in a comfortable position. A debt equity ratio of anything more than two is a sign of caution. Although the D/E ratio of Vedanta Ltd. stands at a comfortable 0.91, the liquidity profile of its holding company Vedanta Resources Plc is under severe stress. Hence, dividend payments are expected to remain elevated going forward. Investors must also draw attention to the high amount of Inter-corporate loans & a self-indulgent chairman who has time & again disregarded the basic rights of minority shareholders.