Advantages & Disadvantages Of Using Dividend Option

As already mentioned earlier, the main advantage of the dividend option is that you can get regular periods if the ELSS performs well. You can use this amount in any way that you want.

On the flip side, you will not get the advantage of compounding your investments if you use this option. The fund house will deduct the value of the dividend payout from the NAV whenever the dividend is actually paid out to you. This deduction doesn't happen in case of the growth option since no dividend is paid out.

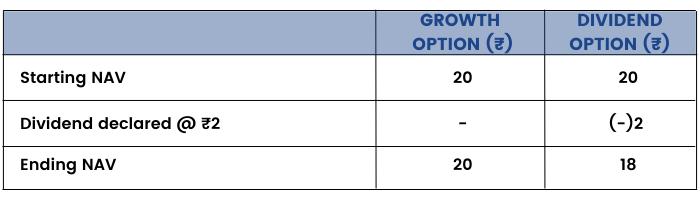

Hence, when you check the NAVs, you will find that the NAV of the dividend option of an ELSS is less than that of the growth option. Let us take an example to understand why this happens:

Suppose there is a fund which is declaring dividends for the first time. Before declaration, the NAV of both options will be the same. However, once the dividend is paid out, the NAVs will become different.

Hence, choose the growth option if you are really interested in building wealth and have no problems in keeping the entire amount (initial investment + returns) in the fund throughout your holding period.