Loans

To fulfill some of our needs and wants, we often take loans. However, successful financial planning involves managing our debts effectively and efficiently. So, in this section, let us understand the basics of loans and the different types of loans available in the market.

What is a Loan?

Simply put, a loan is an arrangement that we make with the borrower. In this, the borrower agrees to lend us money, and in return, we agree to pay back the same money, but with a premium charged on it. This premium is known as the interest, and it is the rate of interest that most importantly affects our loan-taking decisions.

What are the Types of Loans Available in the Market?

When we take a loan from the bank, we often have to provide some sort of security to ensure that the bank can minimize its loss if we fail to repay the money.

It is on this basis that we have the most basic categorization of loans. Loans can either be secured or unsecured.

A Secured Loan is one where you, the borrower, pledge some asset of yours as collateral to the loan. Examples include car and home loans.

An Unsecured Loan refers to any kind of loan that is not attached by a lien on any of your specific assets. Examples include credit card debt & personal loans.

Mostly, loans are differentiated on the purpose of which they’re being taken for. Some of the popular categories of loans here include-

1. Auto Loans

These loans are picked up to purchase a vehicle. Since the lender retains the title of the vehicle till the loan is repaid, it is considered to be a secured loan. Some of the popular banks of the country offer the following rates as on the month of August 2019-

Source: https://www.deal4loans.com/car-loan-interest-rate.php

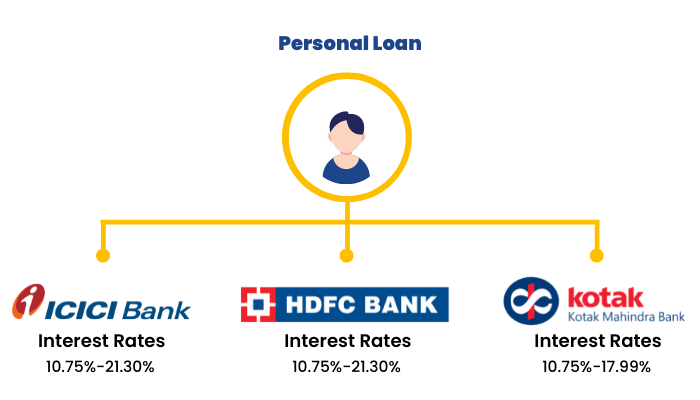

2. Personal Loans

A personal loan can be taken for any purpose but is usually taken to fulfill major household expenses like medical and wedding expenses. Following are the interest rates offered by some of the major banks in the country-

Source: https://www.wishfin.com/personal-loan-interest-rates/

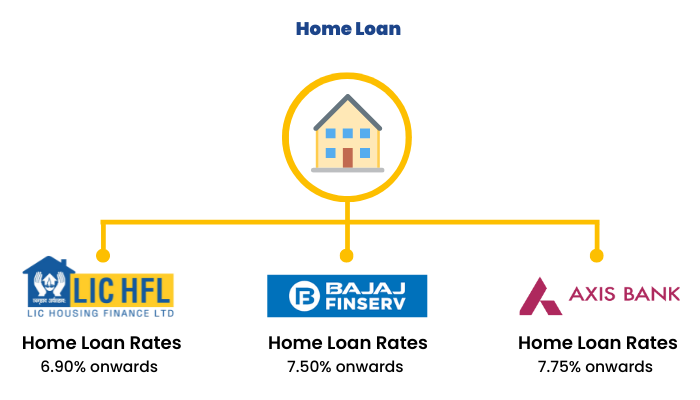

3. Home Loans

A home loan is taken for the purpose of buying a house, or land for constructing a house, among other purposes. These loans are usually secured.

Following are the interest rates available on home loans in popular banks-

Source: https://www.paisabazaar.com/home-loan/interest-rates/

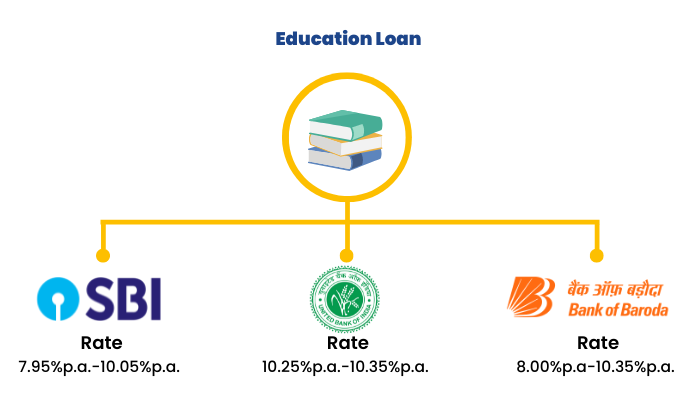

4. Education Loans

These loans are usually taken to pay off the tuition fees of a college course.

These loans take care of the following expenses-

- Fees of the institution including examination and library fees;

- Travel expenses for abroad;

- Cost of books and equipment required;

- Any insurance for the student, if applicable; and

- v. Any additional expenses such as tours, thesis, project work, etc.

These loans are usually unsecured. Following are the rates available for these loans in the country -

Source - https://www.bankbazaar.com/education-loan-interest-rate.html

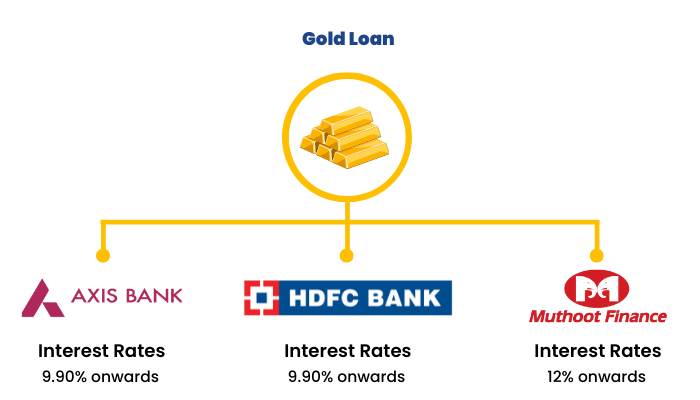

5. Gold Loans

This is a secured loan where the loan money is provided in exchange for gold as collateral. Following are the interest rates offered by various popular banks for this purpose:

After going through these options, you will face the question of how to ensure that you don’t over-borrow and put a strain on your finances. A simple way to check whether you are over-leveraged or not is to find out your Debt to Income Ratio.

Formula = Sum of monthly outflows / EMIs / total fixed monthly income

Ideally, this ratio should not be more than 30%, else you might be exerting strain on your income to service your debt.

How can we build our wealth using loans?

Taking a loan can be a great way to build your wealth provided you know how to use it smartly within the laws of land.

For example, a home loan or a car loan can help you achieve your financial goals of buying a home or a car (by making payments over a period of time) without having to wait and save enough to make an outright purchase by paying a lump sum amount.

In case of a home loan, there are tax benefits both on principal repayment and interest payment. Since you are not going to pay in lump sum but via EMIs so it provides a way to build an appreciating asset like a residential flat. Therefore, if you make informed borrowing decisions, you will be able to generate assets with the help of loan funds as well. Also, when one takes loans, they don’t have to pay the amount back in lump sum. We are liable to pay the loan amount in EMIs, as discussed ahead.