Revenue

First, let us start with the top line item of the income statement, i.e., 'Revenue.'

Revenue, also commonly known as sales, is generally the most simplistic component of the income statement. It represents the total amount a company has earned during a specific time period as a result of its core business operations. Revenue is also referred to as "the top line" since it is listed at the top of the income statement.

For instance, ABC Corporation produces and sells 100 pens in a year @ ₹ 8/-a piece. The total annual revenues for the company shall be equal to ₹ 800.

Revenues are judged on the basis of their stickiness. Temporary increases, such as those resulting from short-term promotion, are less valuable and should not be treated with high regard.

Markets reward companies that continuously show an increase or growth in revenue every quarter/ year. Companies like Tata Consultancy Services (TCS), HDFC Ltd, Reliance Industries have generated huge shareholders wealth because they have continuously shown growth on their top line front (revenue front).

Investors must also note that cyclical companies (fluctuating revenues) trade at a discount to consistent compounders (steady growth in revenues and net profits).

Click here to know which companies are constantly having increasing revenue.

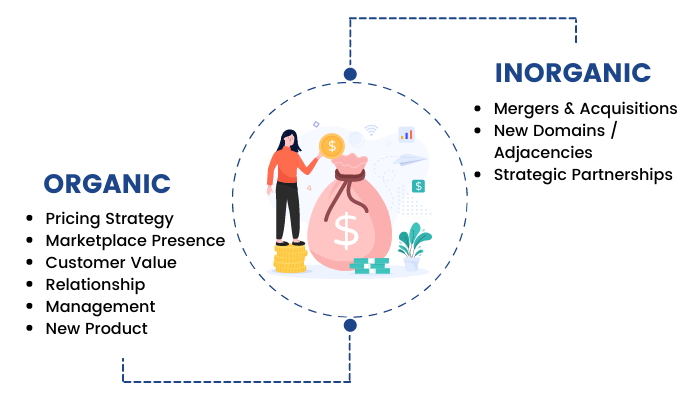

Following are the two ways in which revenue growth can be achieved:

- Organic Growth: It is the growth in a company's revenues & profits which it achieves by increasing output and enhancing sales. This can be done by introducing new products or expanding into other geographies.

Organic Growth excludes any revenues/profits acquired from takeovers, acquisitions or mergers. Takeovers, acquisitions and mergers do not bring about profits generated within the company and therefore, are not considered organic.

Organic growth is the true indicator of the growth of a company, showing how the management utilizes its existing resources to expand its sales. If the revenue growth comes organically then this is highly rewarded by the markets.

- Inorganic Growth: It is the growth in a company's revenue on account of mergers or takeovers rather than an increase in the company's own business activity. Inorganic growth is seen often as a faster way for a company to grow when compared with organic growth. However, the market rewards inorganic growth only when the cost of acquisition or a merger is reasonable. If the former is not true, then the acquiring company is heavily punished for this action.

Corus by Tata Steel, Jaguar Land Rover by Tata Motors, Novelis by Hindalco are some acquisitions in recent corporate history for which the acquirers had to pay dearly, both in terms of operations and share price.