The Stock Market Level In Historical Perspective

The locution "irrational exuberance" was first coined by Sir Alan Greenspan on December 5th, 1996 to better express the behaviour of stock market investors. Soon after which, the stock markets fell impetuously. The reaction to this specific phrase reflected the public's apprehension that the markets may indeed have been bid up to inordinately high and untenable levels under the influence of market psychology. It strongly suggested that the stock market would become a less promising investment in the near future.

MARKET HEIGHTS

Large stock price increases suddenly occurred in various countries across the globe at the same time. The impending question loomed large above everyone - whether the current period of high stock market pricing would be followed by a poor or negative performance in the upcoming years, as had been the case in the past.

PRICE RELATIVE TO EARNINGS

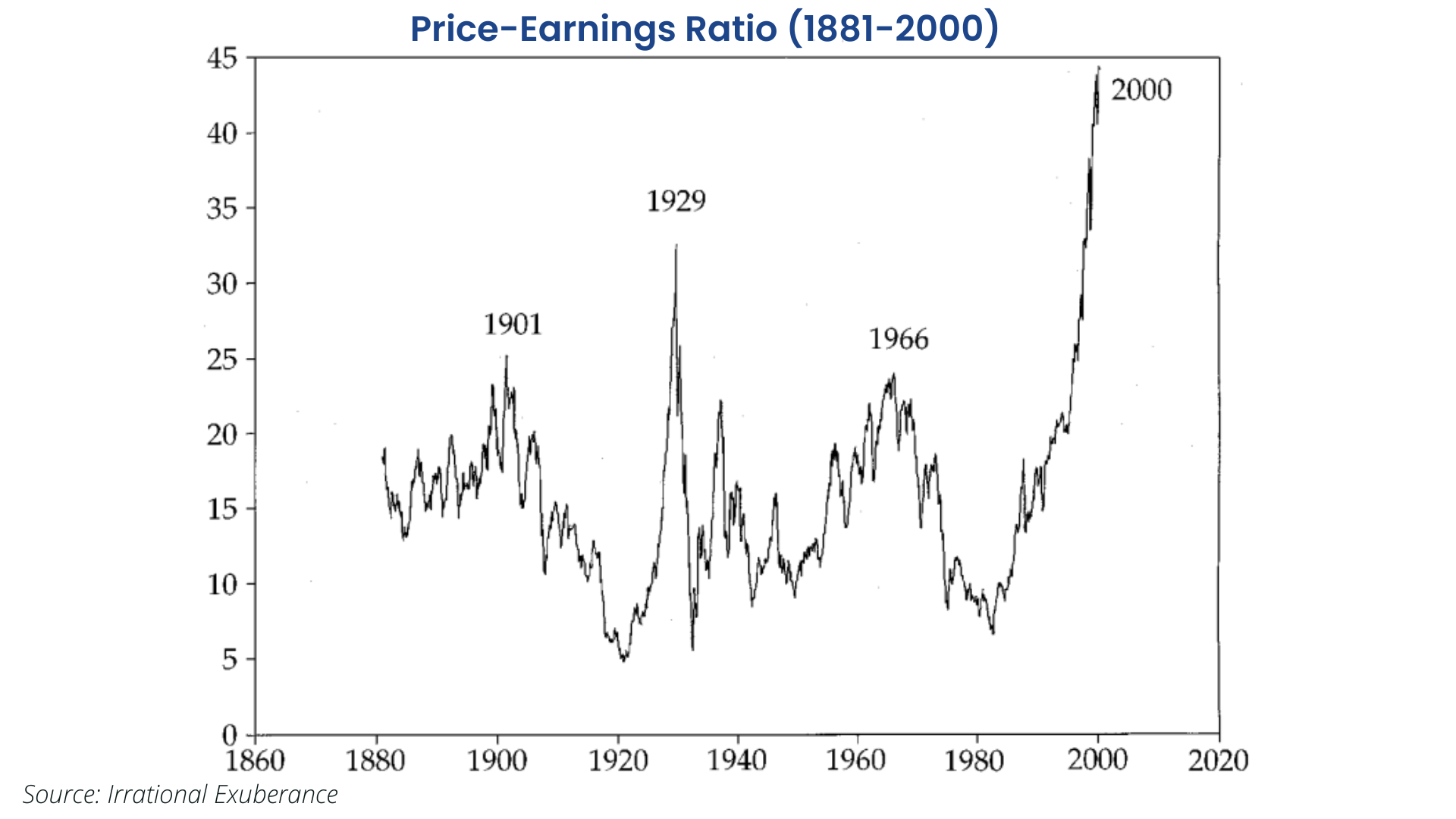

Earnings seemed to be oscillating around a slow and steady growth path that had persisted for over a century. Using the 'ten-year average of real earnings' as proposed by Benjamin Graham, such events as the temporary burst of earnings during World War I and the temporary decline during World War II, or even the frequent boosts and declines that we see due to the business cycle, were smoothed out.

What is extraordinary today is the behaviour of price, not earnings.

PRICE-EARNINGS RATIO

The peak of high price-earnings ratio occurred in January 1966 which was popularly referred to as the Kennedy-Johnson peak. The simple logic- that when one is not getting much in dividends relative to the price one pays for stocks, it is not a good time to buy stocks - also proved to be correct.

WORRIES ABOUT IRRATIONAL EXUBERANCE

Most people are left baffled by the seemingly high levels of the market. People are in a quandary whether the high levels of the stock market reflect unjustified optimism, the kind of optimism that might pervade our thinking and affect many of our life choices. No one quite knows what to make of any sudden market correction in recent times. There is always an apprehension about the previous market psychology returning.

It is still a conundrum whether the market levels make any sense or whether they are indeed the result of some human tendency that might be referred to as "irrational exuberance"