The Life Of A Company

The Company at Birth Someone has a brainstorming idea and invents a new product. It could be anyone, not necessarily a VIP, PhD, college graduate. It could be a high school or a school dropout even.

- Example Body Shop—Started in Anita Rodrick’s garage. She was a British housewife looking to do something while her husband was away on business trips.

- Hewlett Packard started in a packard garage.

- Apple was produced in a garage by two college dropouts- One was Steve jobs and other was Steve Woznaik.

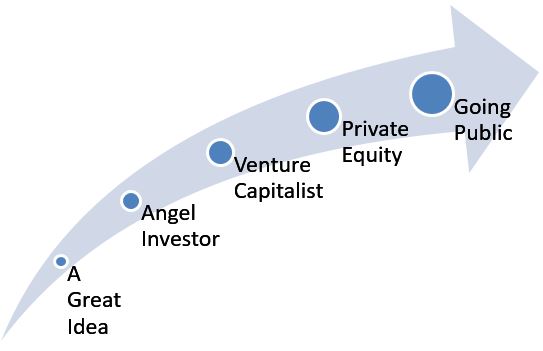

These are the stages:

- A person has a great idea but you cannot succeed if he is selfish and keeps 100% of profit ownership for himself.

- The Next stage is to find an Angel investor who is a rich uncle, aunt, father who likes the idea and wants to invest in the project.

- This is followed by the next stage which is a venture capitalist who is convinced about the product and would like to take the risk on that.

- Then comes the second line of investing like private equity etc.

- And lastly, it's the public investing when the company goes public.

Going public:

- The life of a politician is no longer his or her own, and neither is the life of a company that goes public.

- A company has two birthdays – the day it incorporates and the day it goes public i.e. the day of its INITIAL PUBLIC OFFERING (IPO)

- The company appoints an Underwriter to undertake the IPO process

- The Underwriters are bankers who are entrusted with selling shares to interested parties. They even go out for “road shows” trying to convince the people to buy the stock.

There is a Prospectus that explains everything about the company, including all the reasons why they should and they shouldn’t buy. These warnings are written in large red letters and are called “red herrings”. - Once the IPO is complete-a small chunk of money goes to the underwriters, another chunk goes to the founders of the company, Angels capitalists, VCs –who might use the offering to sell some shares and the rest of the money is returned to the company itself. This is the capital used to expand the business.

- The only time a company benefits from its own stock is during public offering.