Factor 5 – Inflation

Inflation signifies an increase in the aggregate price level of a basket of goods & services. In India, The Consumer Price Index (CPI) and The Wholesale Price Index (WPI) are the widely accepted barometers for tracking inflation. An Interest rate hike is the textbook solution to counter inflationary pressures. However, high-interest rates are against the greater good of society. The Central Bank stands in midst of this bemusement & balances its stance between Hawkish & Dovish.

It is argued that equities are a great hedge against inflation. This is primarily because earnings tend to rise in tandem with the general price rise in the economy. A moderate price rise is generally considered to be an indicator of a healthy economy.

How do you exactly quantify "moderate" inflation?

For starters, The Reserve Bank of India has set a target inflation band of 4% +/- a band of 2%. Any number within this range can be termed reasonable in the Indian context. A high inflation number might be a sign of an overheated economy.

Although expectations of inflation are baked in nominal interest rates offered to fixed-income security holders, any surprise on the flip-side can eat into the real returns.

Rapid Inflation increases the input costs of companies. For instance, an increase in Crude Oil prices is beneficial to Upstream Oil companies such as ONGC, Oil India, HOEC, etc. but it might severely dent the prospects of companies such as Interglobe Aviation, Asian Paints, JK Tyres that use Crude Oil as a raw material.

Similarly, Rising Iron-Ore prices will improve the earnings outlook for Iron-ore producers such as NMDC, Vedanta, and KIOCL. Nonetheless, stocks such as Tata Steel, Jindal Steel & Power, JSW Steel that use Iron-Ore as a raw material in the steel production process are expected to react negatively to this news development.

An inflationary environment is a death knell for those companies who do not command sufficient pricing power. It may also happen that companies are abstaining from transferring the increased costs of production on account of a benign economic environment. Leaders of the next market rally will be likely those who show resilience in tough times & seek to innovate during periods of downturn.

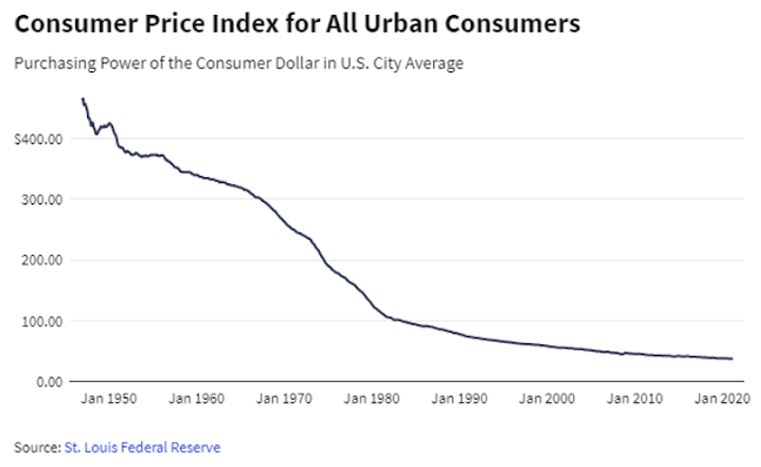

With time, Dollar Bills aka US Currency notes have been reduced to worthless pieces of paper. The steady declining purchasing power of the US Dollar is a great proxy of how Central Banks across the globe are colluding to steal from the pockets of the common man. Shoe-leather costs have gone up significantly since

By a continuing process of inflation, government can confiscate, secretly & unobserved, an important part of the wealth of their citizens - John Maynard Keynes

The graph on the previous page depicted how the money supply in the USA has gone up year after year, relentlessly. This slide however does justice to those statisticians who claim to have "uplifted" the economic doom by keeping the printing press rumbling, by providing a complete perspective.

No, the Greatest Heist in history was not the one connived by The Professor at The Royal Mint of Spain. It has been going on since the advent of the Modern Monetary Theory. It is happening right now as you are reading this module and another Dollar or Pound or Yen or Euro is printed out of thin air. This phenomenon essentially summarizes that there are no free lunches in this world.