Short Call

Secondly, let us understand a ‘Short Call.’

A short call involves the selling of a call option. It is a slightly bearish and neutral strategy.

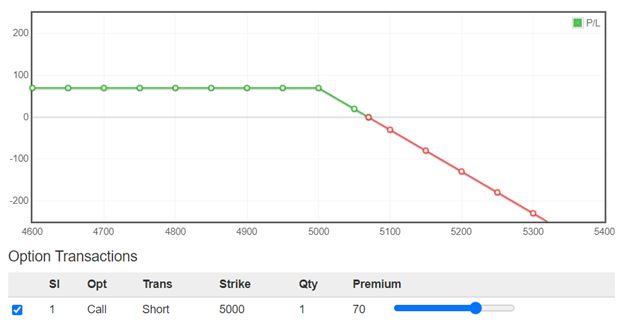

The strategy has limited reward potential and unlimited risk.

A short call strategy has a positive pay–off when there is a fall in the underlying stock or volatility contraction. The strategy has a negative pay-off when there is an increase in the underlying stock, or volatility expansion.

Normally it’s advisable for traders to sell the call at a strike price which is greater than the current market price of the underlying asset i.e. Selling an Out of the Money (OTM) call.

Below is the illustration of the payoff diagram of a Short Call Option:

The key incentive of selling a call is that you can profit under three scenarios:

- when the underlying stock declines,

- move sideways,

- or rise slightly

The probability of success in the trade is 2/3rd. An advantage of selling a naked call is that it can be structured to have a higher probability of success than trading the underlying stock or buying a call. A disadvantage to selling any option is that you have unlimited risk if the asset price rises and goes above the strike price.

A call option seller has time on his side and with each passing day, premiums fall considering other factors don’t move much.