The Financial System

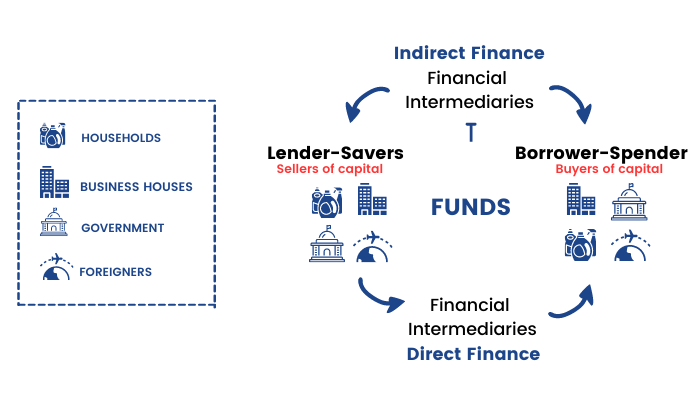

Financial market is a platform where buyers and sellers are involved in the sale and purchase of financial products like shares, mutual funds, bonds and so on. Alternatively, the financial market is a place where the savings from several sources are mobilized towards those who need funds. Buyers of capital and sellers of capital channelize money through various financial instruments.

What constitutes the Securities markets in India?

There are three important elements constituting a Securities Market:

- Buyers of Capital

- Sellers of Capital

- Intermediaries

Buyers of capital: These are the people who constitute those set of people who are the net spenders in any economy. They take capital from the savers and utilize it. Example: Corporate houses, Government etc.

Sellers of capital: This class constitutes the group of people who are net savers. These are the people who are net providers of money to the people who need money. Example: Retail Investors, Big Investors like Rakesh Jhunjhunwala.

Intermediaries: These are the class of people who are the providers of finance to the spenders. They facilitate the movement of money from the savers to the spenders. The market mediators play an important role on the stock exchange market; they put together the demands of the buyers with the offers of the security sellers. A large variety and number of intermediaries provide intermediation services in the Indian securities markets. The banks play an important role as an intermediary in the securities market.

Unlock the secrets of the stock market with our 'Stock Market Made Easy' course. Enroll now and master the financial system!

We got a brief idea of the financial system from the above picture and the stock market is a part of it. So, in the next unit, let us first understand- What is a stock?