How Price Swings are traded?

Swing trading can be done in two possible ways:

1. Identifying the primary trend and riding it.

For example, you analyze a stock that has been in a long-term uptrend. Swing traders can seek to enter this stock on pullbacks from the trend and then look to benefit when the primary trend resumes.

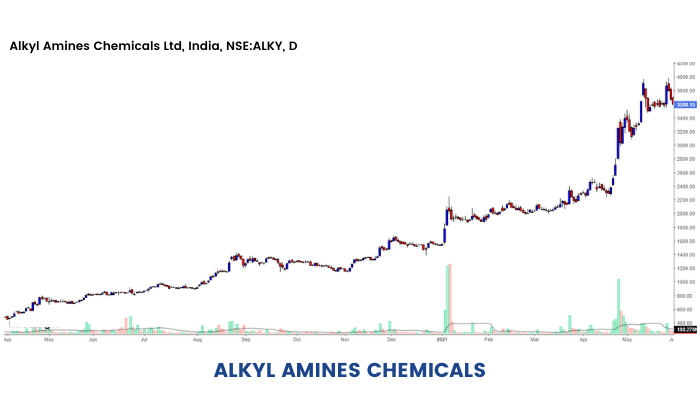

The stock of Alkyl Amines (NSE: ALKYLAMINE) has been in a strong uptrend since May 2020. In this journey from ₹408 to ₹3,775, the stock has given multiple pullbacks where traders could build positions. More specifically:

This once again proves the thesis that no stock goes up linearly. When it does go up, it is likely to give a lot of opportunities in the form of minor pullbacks. And it is on these minor pullbacks that the smart traders build their positions.

2. Trading range-bound markets

Range trading can be done by identifying support and resistances and aiming to capture swings when prices hit either support or resistance.

For example, traders can pick a fundamentally sound stock at a strong support and then sell the stock when it reaches its established resistance, thereby making a profit.

Consider a stock that has established support around ₹500 zones and has not fallen below this level for some time and has an established resistance at ₹600. Swing traders will typically wait for the stock to reach either the support or resistance to initiate a trade.

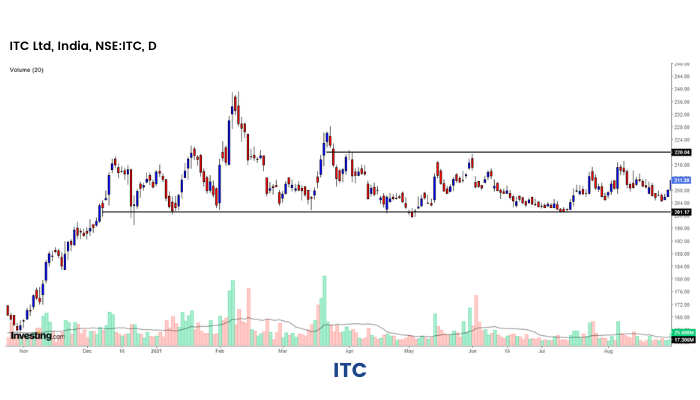

The stock of ITC Ltd (NSE: ITC) has strong support zones around ₹200 levels and the same can be inferred from the chart above. The stock has bounced back eight times in the last seven months from its support zones. Stocks like ITC are a goldmine for swing traders. Traders can go long in the stock when it reaches its established support zones and exit at resistance zones of ₹220 or thereabouts.

A note of caution while employing this tool, traders must avoid fresh positions once this range breaks on the either side with substantial volumes.

The stock of Reliance Industries (NSE: RELIANCE) spent eight years from 2009-2017 in a narrow consolidation zone. Now, if someone were to employ this strategy after the stock gave a breakout in 2017, he/she would be in for a doomsday scenario.

The stock has gone up by around 4x since then.

This implies that swing traders must be flexible enough to shift from a range bound trading strategy to a directional trade once the stock gives a breakout/breakdown.

However, traders should have a clear objective while making Swing Trades. We will discuss some common objectives of swing trading in the next section.