Know The Truth About Your Trading

The power of measurement is a priceless tool for those who are disciplined to use it routinely. When a trader keeps a track of the trading results, can gain insight into his trading that no system or indicator can ever tell. The results show the true picture of everything, from identifying trades to the consistency in executing them.

However, the sad truth is that very few traders know the truth about their trading. This is because people don't prefer to look at their bad trades. This is their biggest mistake.

How can traders avoid making this biggest mistake?

- The first step is post-analysis of your results.

- Every trader should collect their trading data and calculate their numbers. The data should be recorded according to the strategy. This will help in controlling the risk/reward ratio for each trade.

- They should be committed to updating the record regularly without fail.

Winners don’t take things for granted. They realize that every experience whether good or bad is a lesson that should be studied and built upon. They understand the restriction of only committing things to memory. They are always prepared with a journal to reflect and compare expectations to reality. The journal acts as a detailed guide for dealing with the next trades.

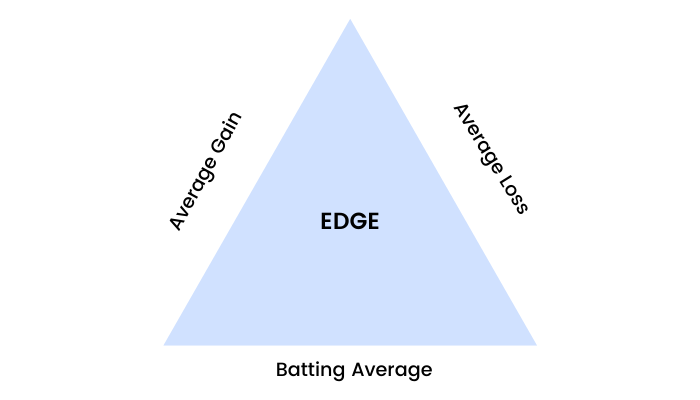

Mark compares trading to photography. Photography exposure is determined by three variables, light sensitivity, shutter speed and the size of the camera aperture. This “triangle” of factors determines the exposure. Similarly reading too has a triangle of three legs. These legs are:

- Your standard win size: how much do you win across all your winning trades on a percentage basis?

- Your average loss size: how much do you lose across all your losing trades on a percentage basis?

- Your ratio of profits to losses: your percentage of winning trades.

Image source: Think And Trade Like A Champion

Mark identifies the ‘stubborn trader’ indicators. They are the largest gain and loss in any one month and the number of days those gains and losses are held. For an average of a 6- to 12-month period, the net result should be positive.

For example, if the largest gainers are smaller than the largest losers on average, this means stubbornly carrying losses and only taking small profits, the exact opposite of what one should be doing. If the average hold time on the winners is less than the average hold time on the losers, it again indicates holding onto losses and selling winners too quickly. Tracking this data will give an honest picture of a person’s trading.

The power of “small” gains compounded overtime should not be underestimated. Elevated turnover of fairly small gains can mean considerably higher returns compared to lower turnover with higher profits.

The basic intent of any business endeavour is to have average gains larger than average losses.

The only solution to battle anxiety and control fears are rules and realistic objectives. With persistent rules, decisions will be grounded in reality and will not be emotionally based.

One must never let himself get absorbed with regret or bound with indecisiveness. Utilize the “sell-half” rule.

When a trader sells half and the stock goes higher, he will feel thankful that he has half the position left with him. However, if the stock goes lower, he again feels happy that at least he booked half the profit.

Psychologically, it’s a win/win situation in both ways.

One must be aware of the fact that selling half does not work on the downside when at a loss. When the stop is hit, the trade must be exited instead of selling half and gambling with the other half of the position. When a position moves against the view and hits the protective sell line, there is no room to fiddle but just act decisively and in a disciplined manner.

The author also emphasizes following healthy routines in trading. He calls them Lifestyle Habits. Once these habits are developed, they help in the progression and expansion of the comfort zone. One of the healthy habits of trading is regularly executing a post-analysis of results.

Another is cutting losses without failing to protect against capital destruction.

One of the biggest obstacles to success is making excuses. A trader should know the power of owning his results and should take full responsibility for the same. It is either possible to make money or excuses, but both can't be made together. One should work towards eradicating their excuses and start on the road to success by taking responsibility.