Trading Systems

Triple Screen Trading Systems:

The Triple Screen system was first presented to the public in April 1986, and, as the name suggests, it applies 3 screens or tests for every trade. Triple screen system combines the trend following methods and counter-trend techniques.

The markets are too complex to be analysed just by a single indicator. Trend following indicators rise during uptrends and thus, give a buy signal and oscillators give the sell signals.

A major problem is selecting a proper timeline for identifying the trends. For example, a weekly chart of stock may show an uptrend, but a monthly chart for the same stock might show a downtrend.

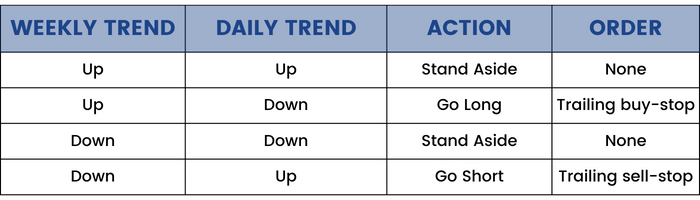

The Triple Screen System first examines the longer-term charts and after that the shorter-term chart. We can use a weekly MACD Histogram. The slope is set as the relationship between 2 bars. When the slope is up, it indicates that the bulls are in control and vice-versa.

The 1st screen identifies the uptrends on a weekly chart.

The 2nd screen identifies the downturns. The second screen applies oscillators to identify deviations from the weekly trends to find buying and selling opportunities.

The 3rd screen identifies the entry points for an investor by using the intraday charts.

“Proper money management is essential for successful trading”.

A good trader always cuts their losses and outperforms others who cling on to it and keep hoping for a reversal.

Parabolic Trading System:

A parabolic trading system identifies trends and reverses the positions when a trend reverses.

The parabolic system provides discipline to a trader and stops them from making bad decisions.

Trading rules:

1)When the market is in a strong uptrend, go back several weeks and apply the Parabolic Trading System. Calculate the stop loss orders after updating the parabolic system to the current day and protect your losses in a long position and vice – versa.

Channel Trading Systems:

Prices always flow in channels, just like rivers flow in valleys. Channels help traders identify buying and selling decisions and make a trader avoid his bad decisions.

Channels parallel to trendlines are extremely useful for long – term analysis. They also show where to expect the support and resistance levels in the future.

A channel’s slope can identify a market trend. When a channel lies flat, trade all your positions within its walls.

Moving Average Channels:

A 13-day EMA channel is very important for a channel. A channel shows boundaries between a normal and an abnormal price action. Usually, a normal price channel is pushed outside because of unusual events.

If the prices touch the upper channel line, it signifies that the market is bullish and we should sell.

There are some trading rules mentioned for channels:

1)When a channel is flat, always buy and vice – versa.

2)When a channel rises and an uptrend is happening, a momentum signifies bullishness, a chance to sell will come very soon. This rule also works in reverse sharp downtrends.

3)When the prices reach an upper channel line but indicators like stochastic, trace a lower high, then a sell signal is given and vice – versa.

4)Buy when a channel is rising but is below the moving average, and cover your positions on the upper channel line.

Bollinger Bands:

Standard Deviation Channels, or Bollinger Bands are unique instruments because their widths change in response to market volatility.

Bollinger bands are very useful when a trader is dealing in options.

Buy with the help of Bollinger bands when there is less volatility in the market and options are cheap. Bollinger bands become wider when markets are volatile and shrink when markets are stable.

When prices rise out of a very narrow Bollinger band, it gives a signal to buy and vice – versa.