Public Sector Units

The book's seventh chapter examines PSUs (Public Sector Units or government-owned companies) and discusses the reasons for the perception of underperformance in those stocks. As some of the reasons for this, the author discusses the absence of Availability Heuristics (not much information is available about those companies, unlike private sector companies, which are tracked by every analyst and his mother in law) and Herding - All PSUs are grouped. The critical point being made is that some PSU units, such as SBI and oil companies, are trading at extremely low valuations and offer significant long-term returns.

Key Takeaways

In the long run, markets are efficient, but in the short run, they are inefficient. Moreover, the nature of markets has changed due to the introduction of technology and the Internet and the disappearance of financial borders.

Returns are determined by purchasing a valuable asset at the right price. However, it is not as simple as it appears. When such an opportunity presents itself, we dislike it because our emotions and the environment influence our decisions.

It's not that most long-term investors were unaware of the PSU investment opportunity. Instead, it was the willingness to consider the long term that was lacking and returns are always a function of time.

In terms of the environment, investors were concerned about the government's lack of political will to implement reforms. Price controls killed the fertilizer industry. This anchor was too strong in investors' minds, and the woes of the oil marketing companies proved such cautious investors correct.

What has generated the returns in specific industries such as banking, mining, container shipping, and defence?

The first was that these sectors were opened up to reforms more quickly. Second, they were in monopolistic industries. Third, and most importantly, they successfully attracted investor interest over time. This was accomplished through consistent growth in profitability and size.

Most of these successful PSUs owe their success to their size and scale. The market capitalization game is still active in the market today.

Because there are investors from all over the world looking for investments in various countries, they look for a specific size. Even a great 'blue chip' will not be on such investors' investing list if it does not have a sizable market capitalization. This is where PSUs have an advantage in terms of market visibility. In addition, they have assets, infrastructure, knowledge, a client base, and a network to back up their claims. This also facilitates their access to capital markets. These significant issues will pique the interest of large foreign institutional investors.

Foreign institutional investors as a group are permitted to hold shares up to a specific limit, which has already been reached in the case of SBI.

This scale and size, once again, aid a company's entry into the index. Index traders and those seeking country exposure typically invest solely in index stocks. As analysts cover such highly capitalized index stocks, PSUs will gain a strong investor following. The stock market is all about the herd. A fancy stock has a herd following it because it is a large-cap stock in the index. And because fancy stocks have high built-in expectations, their stocks appreciate. When you buy early, you get a good return on your investment.

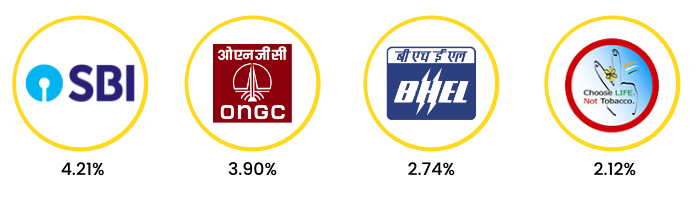

As of April 23, 2008, the BSE Sensex comprised four major PSUs, with SBI leading the pack with a weightage of 4.21 per cent, followed by ONGC with 3.90 per cent, BHEL with 2.74, and NTPC with 2.12 per cent.

Together, they have a weightage of more than 12%, which is relatively low given the scale and size of PSUs in India. The NSE Nifty is represented by nine PSUs, with a weightage of more than 22%. More PSUs will be listed in the future, providing investors with excellent investment opportunities.

A wise long-term investor cannot, without a doubt, overlook PSU stocks.