Cyclical Stocks

What are cyclical stocks?

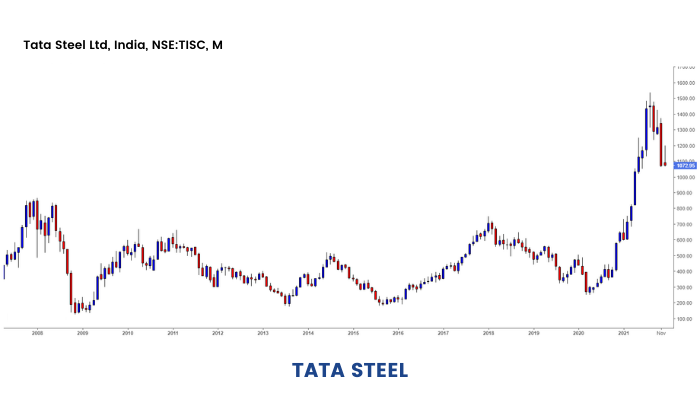

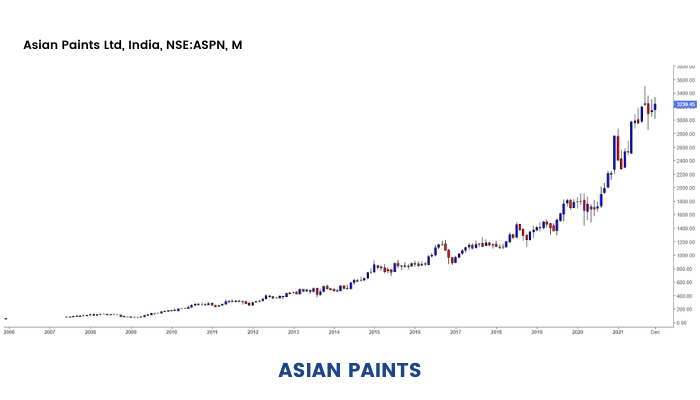

Before I answer this question, Have a look at these two images below-

The former price chart is of India's largest steelmaker - Tata Steel

The latter depicts the rise and rise of beautiful homes- Asian Paints

Notice the stark contrast in how both these stocks move. The Tata Steel Stock is nefarious for wild movements on either side. Asian Paints is relatively quiet but has been growing investor wealth consistently.

Well, it's time to pat yourself on the back. You have just learned the easiest way to identify a cyclical stock. And it is the same story universally:

Dealing in Cyclical stocks will give you the same adrenaline rush as riding a Roller-Coaster ride in an amusement park. And needless to say, there is a caution note advising the faint-hearted to stay away.

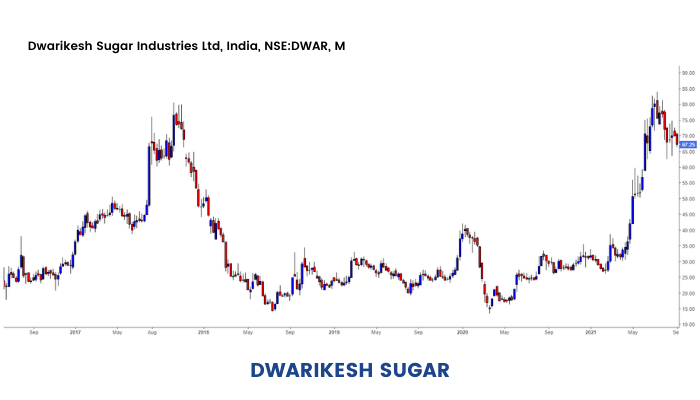

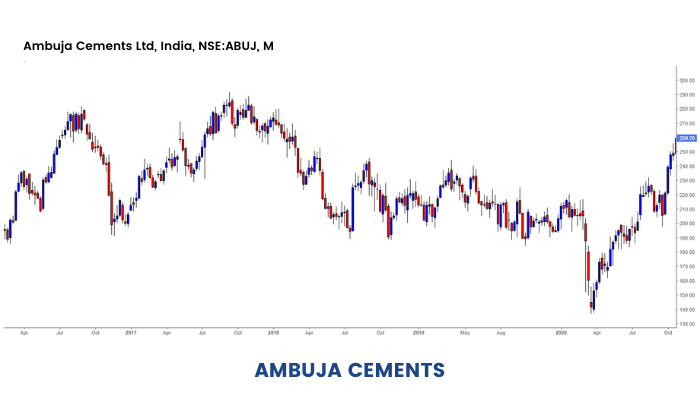

According to Peter Lynch, cyclical stocks are those whose revenues and profits are in tandem with the state of the economy with their performance being tied to the business cycle. These stocks outperform the market during a bull run and underperform when bears take over. Cyclical stocks are vulnerable to the overall state of the economy. Cement, Capital Goods, Construction, Metals, etc. are good examples of cyclical sectors.

Next, let's talk about why choose cyclical stocks?