The 4 stages of Market Cycles

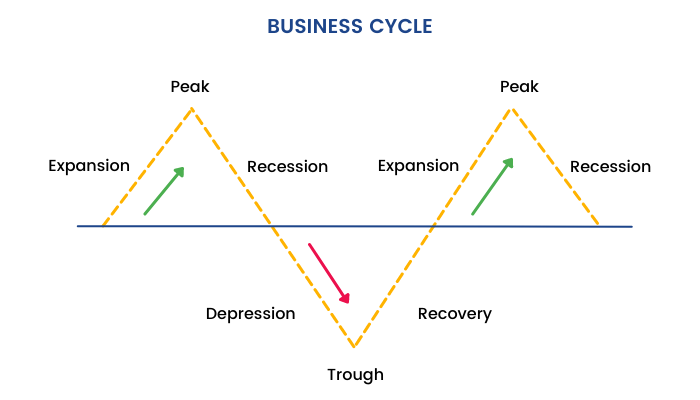

Economic activity is not linear; it is cyclical in nature. Periods of expansion in economic activity are followed by periods of contraction and similarly, periods of contraction are followed by periods of expansion. Periods of economic expansion are characterized by rising corporate profits and business optimism. On the other hand, periods of contraction are witness to poor business sentiments and falling profits.

A typical market cycle begins with a period of expansion which can also be looked upon as a recovery from the previous bust. This gradual growth (boom period) phase manifests into madness and the cycle hits its peak. As a result, the economy cools, stock markets fall and there is rampant pessimism (contraction). Eventually, doom gives way to hope, the market reaches a trough and the cycle starts all over again with another period of economic expansion.

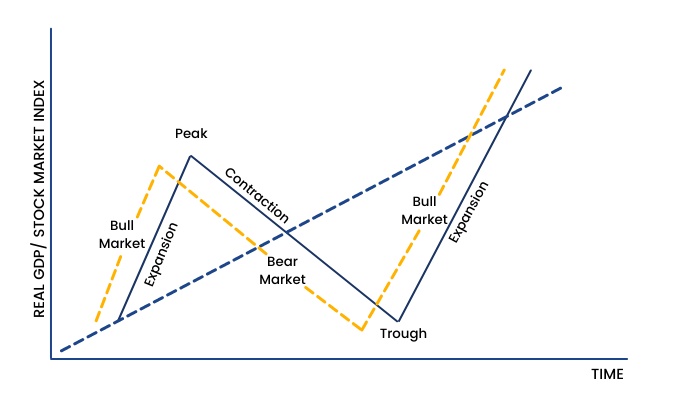

An important point to notice in the above graph is the long-term trend of GDP. It is steadily rising upwards when viewed on a larger time frame. This is an important point to keep in mind for an investor when the market is on a downward trajectory. It certainly is scary to see red flashing all over the screen but one must be patient and marquee names in times of distress. Another way to interpret the same picture is that the stock market and the real economy are often in disconnect with each other. And yes, it is most of the time!

Lastly, the above graph is an oversimplified portrayal of an economic cycle. The market prices will not reflect such linear movements. During periods of expansion, the markets will not trend upwards in a straight line. Instead, periods of expansion will witness many days of across the board selling. Likewise, it would be unfair to expect lower circuits all the way to the market bottom during periods of contraction.

As an educator with India's best stock market platform, I get to interact with a lot of like-minded people. I often come across questions such as:

How can the markets run up so much when the actual economy is on tenterhooks?

Markets have fallen way too much. How can you justify this move?

Always remember, the market is smarter than the smartest of us. The prices today do not reflect market expectations for the current financial year. The market takes into account one year forward expected earnings. There is a new equilibrium price every second as material information gets reflected in stock prices. This explains why there is significant movement in stock on its results day. A new equilibrium price is agreed upon, based on the revision of earnings forecasts. The exchange acts as a platform for price discovery and allows market participants to quote a bid/ask rate of their choice.

The turning points in the business cycle are extremely important from an investor's viewpoint. Investors who possess the skill to anticipate cyclical swings can make a fortune in the market.In order to develop such skills, we must learn what causes a change in the business cycle.