Concept Of Duration

Duration is one of the key characteristics of a fixed income security. It is used as a tool which measures the sensitivity of a bond’s price to a change in its yield.

It is important to understand Duration and Maturity are different terms and shouldn't be confused with each other.

In simple terms, a bond’s duration measures the change in its market value due to a change in its interest rates or yield, i.e., its price volatility.

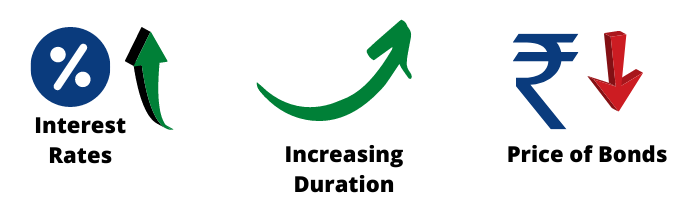

The higher a bond’s duration, the more its price will fall or rise as its interest rate rises or falls.

If a bond’ duration is 6 years and if its interest rate increases by 1%, the bond’s price will drop by approximately 6% (1% X 6 years). Likewise, if its interest rate falls by 1%, the same bond’s price will increase by about 6% (1% X 6 years).

A bond’s duration can be affected by 2 factors:

1.Time to Maturity:

The longer is a bond’s maturity, the greater will be its duration, and the greater will be its interest rate risk. For example, consider 2 bonds with maturities of 5 and 7 years. The 5-year bond will pay back its principal in a shorter period of time, and hence its duration will be lower when compared to a 7-year bond.

2. Coupon Rate:

A bond’s coupon rate is also a key component in determining its duration. Consider 2 bonds that are identical in nature except for their coupon rates. The bond with the higher coupon rate will have a low duration because it will pay back the due amount faster than the lower coupon bond.