Types Of Debt Market And Debt Market Securities

As discussed, Debt is the money borrowed by one party from another to serve a financial need that otherwise cannot be met outright. Many organizations use debt to procure goods & services that they don't wish to pay for using their own funds and also do not wish to dilute equity holdings/voting rights by issuing new shares.

There are 2 types of debt markets - Money Markets, and Long-Term Fixed Income Markets. We will now discuss each market and the securities that are categorised under these markets:

1. Money Market:

Money Market is a market where short-term debt securities, i.e., securities which will mature in or less than 1 year are traded.

An important thing to note is that the money market is not made up of a single instrument. Instead, it is a collection of several instruments. Some of the instruments are Treasury Bills, Commercial Papers and Certificates of Deposits (CDs).

There are many participants in the Money Market. Reserve Bank of India (RBI), Mutual Fund Houses, Banks, Non-Banking Finance Companies (NBFCs), State Governments, Provident Funds (PFs), Primary Dealers, Retail Investors, etc., all participate in the Money Markets.

The Central Bank of India, i.e., RBI, participates in the money market to influence the money supply and the general level of interest rates in the economy. The average daily turnover data for the Money Market of India is reported at ₹735006 Crores in 2020. This implies that money markets in India have a sizable size. Let's discuss some of the most commonly traded securities in the money markets:

A. Treasury Bills (T-Bills):

Treasury Bills or T-bills are short-term instruments that are issued by the Treasury department of various countries. For example, T-Bills in India are issued by the Government of India. T-Bills in India can be issued in 3 different maturities, i.e., 91 days, 182 days, and 364 days.

T-Bills are zero-coupon securities, i.e., they do not pay any interest. Instead, they are issued at a discount to their Face Value and are redeemable at Face Value. For example, a treasury bill with a face value of ₹100 is currently selling at ₹95. This means that you can buy that T-bill today by paying ₹95 and at maturity you will get ₹100. In total, you will generate an income of ₹5 from that bill.

T-Bills are considered to be one of the safest investments. They have zero risks associated with them simply because they are issued by the Government of India.

How can I buy it?

Over the last few years, RBI has encouraged retail investors to buy G-secs like T-Bills. T-bills can be purchased with the help of a demat account. Some banking firms also have this feature.

The minimum ticket size to invest in T-Bills is ₹25,000.

Past Performance:

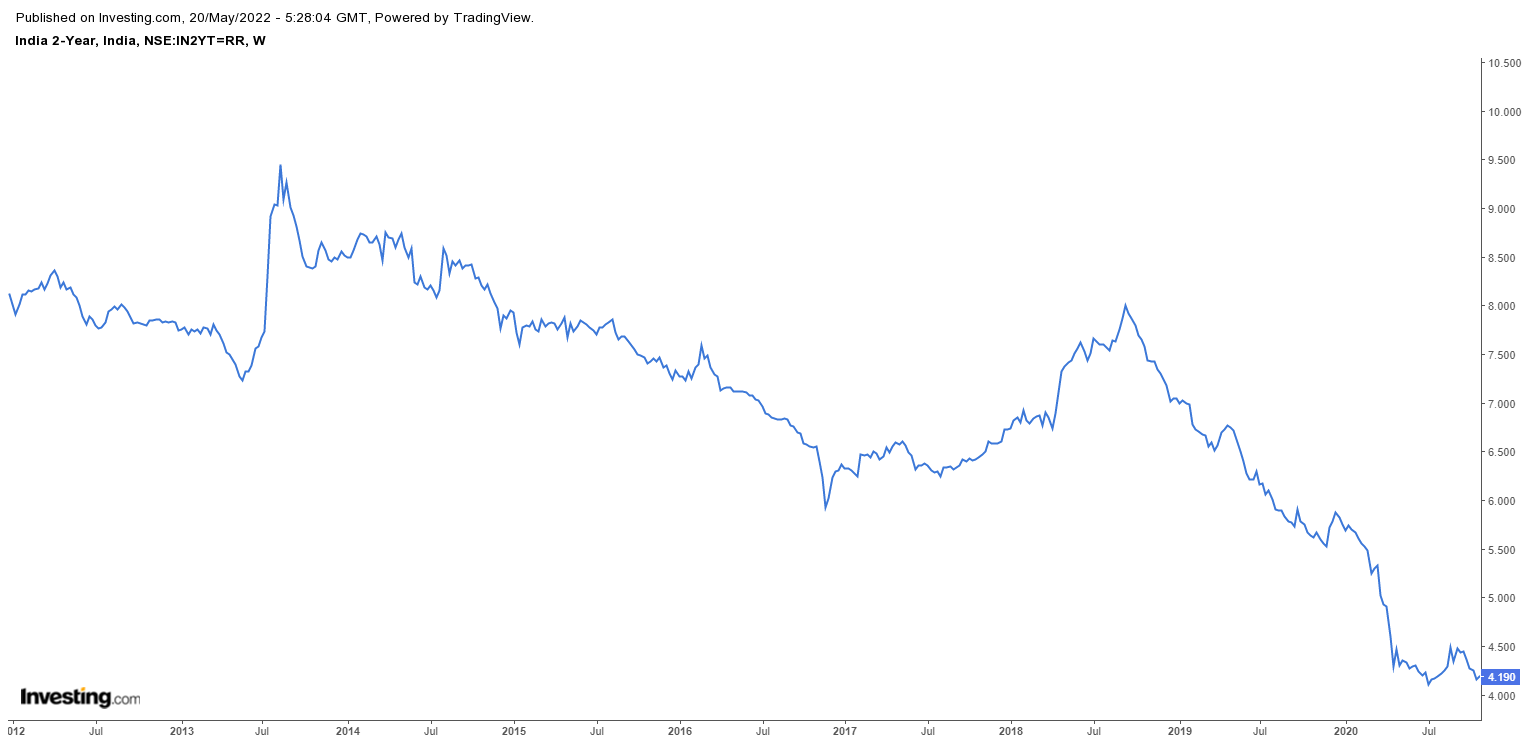

In the above image, we can see the historical rate of T-bills in India, which have been decreasing over time.

B. Commercial Paper:

Commercial Papers are short-term debt securities that can reduce the funding costs for the company that issues them. Commercial Papers are generally issued by large and creditworthy companies.

The advantage of issuing a Commercial Paper is that the interest cost of a commercial paper is less than the interest on a bank loan. Several firms also use Commercial Papers as a temporary source of funding before issuing a longer-term debt. This is also known as Bridge Financing.

Commercial Papers are often rolled over or reissued. The risk that a company will not be able to reissue a commercial paper is called the Rollover Risk. Rollover Risk is related to the refinancing of debt. Most of the companies primarily run on Debt. Over time, a company’s credit quality might decline and it might not be able to refinance its maturing debt. This risk is called the Rollover Risk.

This was experienced by many companies in the 2008 financial crisis. Many companies became bankrupt during this period. The biggest company that was the victim of this event was the Lehman Brothers, which went bankrupt. Before filing for bankruptcy in 2008, Lehman Brothers was the 4th largest Investment Bank in the U.S.

Commercial Paper is an unsecured form of debt, i.e., it is not protected by a collateral.

In the image below, we can see the top companies which have issued a Commercial Paper:

Who can Invest?

Banks, Individuals, Non-Residents, Companies and Foreign Institutional Investors (FII) can invest in a Commercial Paper. The minimum amount required to invest is ₹5 lakhs.

Commercial Papers are available both in physical as well as dematerialised form.

Another option to invest in a commercial paper is to buy Exchange Traded Funds which invest in Commercial Papers. ETFs are very similar to mutual funds but their management fees are low.

You can also visit NSE India’s website to check all the commercial papers which are currently listed:

As on 9th April 2021:

C. Certificate of Deposits:

Certificate of Deposits or CDs are interest-bearing securities that mature on specific dates. CDs are offered in a range of short-term maturities, ranging from 7 days to a year.

There are 2 types of CDs:

1.Negotiable CDs:

Negotiable CDs can be sold and are an important source of funding for many banks. They typically have maturities of 1 year or less and trade in the domestic bond markets.

2. Non-Negotiable CDs:

Non-Negotiable CDs cannot be sold and one is fined if funds are withdrawn before maturity. Just like Commercial Papers, CDs can also be purchased in dematerialised form.

The minimum issue size of a CD is ₹1 lakh and issues are made only in multiples of ₹1 lakh.

Who can Invest?

According to the NDSL’s website, if one wishes to buy a Certificate of Deposit, one has to negotiate a price with the seller. The price is determined by the buyer and seller through physical negotiation, and, if an agreement is reached, NDSL will then act as a Depository Participant(DP) and transfer the securities to the buyer’s de-mat account. The seller authorizes its DP through a delivery instruction slip. Only after the authorization is confirmed, the Certificate is transferred to the buyer.

The trades in CDs are held only through the official Clearing Houses which are National Securities Clearing Corporation Limited (NSCCL), Indian Clearing Corporation Limited (ICCL) and MCX Stock Exchange Clearing Corporation Limited.

Historical Performance of CDs in India:

D. Call Money:

The Call Money Market is an overnight market where surplus funds of banks are traded. It is a highly liquid market.

Here, banks borrow from one another to source large payments, remittances, and to maintain cash or liquidity with the RBI.

The call money market is used in India extensively for the purpose of maintaining the reserve limits set by RBI.

The rate of interest on these loans is known as the Call Rate. Call rates vary daily, sometimes even on an hourly basis.

Historical Rates

E. Collateralized Borrowing and Lending Obligation (CBLO):

Collateralized Borrowing and Lending Obligation or CBLO, is a money market instrument where financial institutions can avail a short-term loan by providing the prescribed securities as collateral.

Generally, institutions that are not allowed to lend from the inter-bank lending markets participate in the CBLO market where they lend and borrow money.

“Any retail investor can become a member of CBLO trading segment, provided he holds a current account with a bank, approved by CCIL for credit and debit of money.”

“The normal market session for retail investors is open from 9.00 A.M. to 4.00 P.M. for T+0 and 9.00 A.M. to 5.30 P.M. for T+1 settlement on weekdays, and from 9.00 A.M. to 2.00 P.M for both settlements on Saturday.” Securities are traded in the CBLO Auction Market.

The minimum lot size of the CBLO Market is ₹50 lakhs.

All of the above instruments have almost the same characteristics but have different issuers.

2. Long-Term Fixed Income Market:

A.G-Sec & SDLs:

G-Sec are tradable instruments that are issued by the Central Government or State Governments of India. G-Sec can be short or long-term, depending on their maturities.

Short term G-Secs are called Treasury Bills and Longer-term G-Secs are called Government Bonds. State Governments can issue Government Bonds only whilst the Central Government can issue both.

Since we have discussed T-Bills, we will only discuss Government Bonds in this section.

Government Bonds provide good safety of capital because they are risk-free.

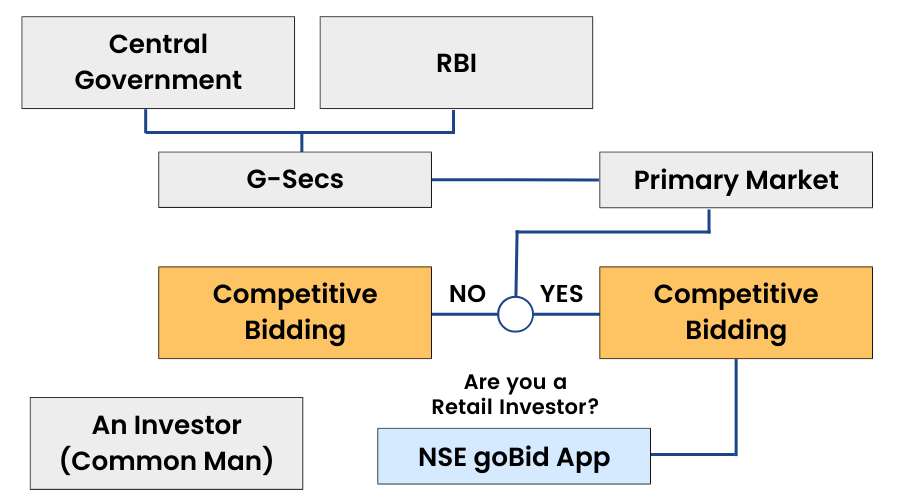

Where can I buy it?

Retail Investors can buy Government Bonds by registering themselves on stock exchanges or by investing in Gilt Funds. Gilt funds are just like mutual funds which invest in various Government securities.

If a retail investor wants to invest in Government securities, he can only do that through a non-competitive bidding process on the NSE goBid App or its website.

According to the official website of RBI, “The Government of India issues securities in order to borrow money from the market. One way in which the securities are offered to investors is through auctions. The government notifies the date on which it will borrow a notified amount through an auction.

The investors bid either in terms of the rate of interest (coupon) for a new security or the price for an existing security being reissued. Since the process of bidding is somewhat technical, only the large and informed investors, such as, banks, primary dealers, financial institutions, mutual funds, insurance companies, etc generally participate in the auctions. This leaves out a large section of medium and small investors from the primary market for government securities which is not only safe and secure but also gives market related rates of return. The Reserve Bank of India has announced a facility of non-competitive bidding in dated government securities on December 7th 2001 for small investors.”

In short, Competitive bidding is a process by which large institutions like banks, mutual funds, etc., can bid for Government securities, whereas Non- Competitive is also an auction for small investors.