Concept of AUM

Previously we have defined what AMC is? In this chapter, we will study the concept of Asset Under Management (AUM) which is integral to the universe of mutual funds.

AUM is the total market value of assets managed by a mutual fund at any given point in time. It includes the capital as well as returns earned on the capital.

As of 31st August 2021, the average AUM of the entire mutual fund industry was ₹36,59,445 crore1. In the last 10-years (between 31st Aug 2011 to 21st Aug 2021), the AUM of the Indian mutual fund industry has grown from ₹6.97 trillion to ₹36.59 trillion – a five times increase.

AUM is a good indicator of a mutual fund’s performance. An increasing AUM indicates that the fund has been performing well and new clients are buying more units, thus injecting more capital into the AUM. A decreasing AUM means exactly the opposite – poor fund performance and redemption by investors.

A fund’s AUM is also an indicator of the credibility of a mutual fund.

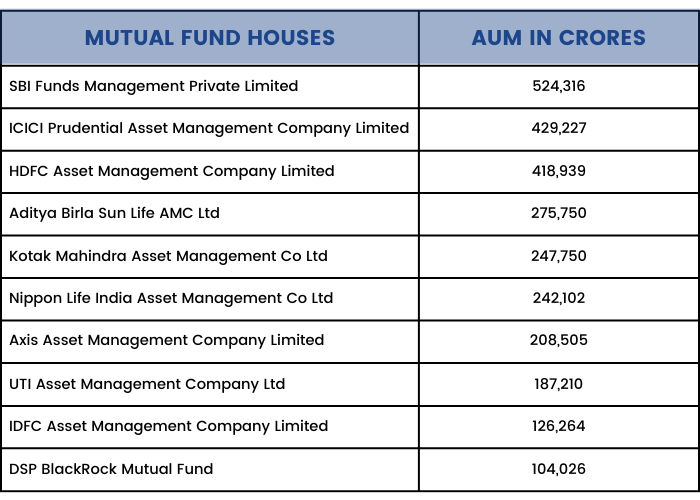

As of June 2021, the top 10 mutual fund companies in India in terms of AUM are given below.

Should You Look at AUM While Investing?

It is very common to look at the AUM of a fund house and think that if so many people have already invested in it, you should do too. AUM does indicate a large client base and in general people’s trust in the found house. It also indicates that a big redemption will not affect the fund adversely.

However, AUM is not a significant factor while choosing a fund. A large AUM does not guarantee better performance. Moreover, the fact that several people have trusted a fund house doesn’t mean it will suit your requirements too.

Having said that, it may be beneficial to use AUM for a peer to peer comparison to evaluate two or more funds in the same category. You can use AUM along with other indicators such as the fund’s historical performance, risk ratio, expense ratio, the background of the fund manager, risk management strategy, compliance, etc. for decision making.

AUM & Fund Fee:

AUM becomes important while calculating the management fee of a fund, commonly known as the expense ratio. The expense ratio covers management and operational costs and is taken in proportion to the fund size.

The Securities and Exchange Board of India (SEBI) has defined the maximum expense ratio that a fund can charge and it is calculated as a percentage of the AUM. Thus, a larger AUM means more expense ratio and vice versa.

Hence, the expense ratio should also be a factor while comparing funds, since the charges you pay will affect your overall returns.