The Breakout And Pullback

After discussing numerous types of Sloping Slides, the second factor which influences the strength of a pattern is the ability to breakout, then pullback into the pattern and finally breakout again. It is one of the strongest signals you can get in Point and Figure charts and enhances the first breakout signal. It occurs when the price breaks out of a multiple top or bottom pattern by one or two boxes but then, instead of continuing, it pulls back into the pattern, before breaking out again this makes the pattern very strong.

It is important when considering any pattern to think about the psychological make-up of the participants. The bulls are euphoric that they have managed to overcome the bears at the breakout. The bears take the opportunity of the higher prices to sell and push the price back down below the breakout point. The bulls want to buy the stock again so they once again overcome the bears to push the stock to a new high.

3-box catapult patterns

- The breakout and pullback pattern was first described as a 3-box pattern and given the name, catapult.

- Strict rules as to what constitutes a 3-box catapult are not necessary; to qualify, all it needs is the following

- A triple or multiple-top/bottom breakout.

- A double-top/bottom is not enough.

- The pattern prior to the breakout could be an extended multiple top pattern, it doesn't matter.

- What matters is that there has been a breakout from a pattern.

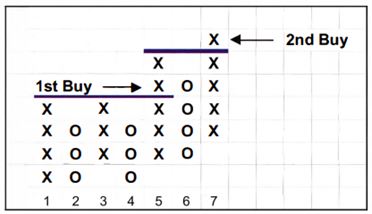

- Column 5 is the initial breakout column.

- This first breakout should be between 1 and 3 boxes. See column 5.

- The price must then pullback into the pattern as in column 6.

- The pullback must not generate a reverse signal.

- It must then turn around and break out beyond the previous breakout column as in column 7.

3-box bullish catapult showing the breakout and pullback.

3-box catapults can be continuation or reversal pattern.