Activity Ratios

Activity ratios are quite different from the types of ratios that we have learned earlier. Liquidity, Solvency ratios measure the financial stability of a company, whereas activity ratios measure the firm's efficiency in terms of its daily business operations. So, let us learn activity ratios in detail.

What are Activity Ratios?

These ratios measure the operation ease of the management in working capital and asset management. These ratios intend to measure how efficiently the company manages its various assets. Some examples of activity ratios include Turnover ratios, Efficiency ratios and Asset utilization ratios.

Different types of turnover ratios are discussed below:

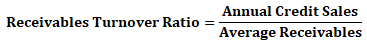

1. Receivables Turnover Ratio:

This ratio measures with ease which company is collecting its payments from the clients to whom the goods/services are provided on credit.

A very low ratio means that customers are paying too slowly which means too much capital is tied up in current assets. It also implies that the company should re-assess its credit policies for timely collection of impaired credit which is not earning interest for the firm. However, a very high ratio might indicate that the firm's credit policy is too rigorous which might be hampering its sales and it also implies that a company is operating on a cash basis.

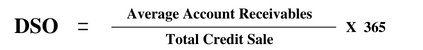

2. Days Sales Outstanding (DSO):

DSO reflects the elapsed time between a sale and cash collection, reflecting how fast the company collects cash from customers to whom it offers credit. With the high importance of cash running in business, it will be in the best interests of a company to convert the outstanding receivables as soon as possible. By quickly turning the outstanding sales into cash, the company has the option to put the cash into use again to be more precise, to reinvest and make more money. The DSO can be used to measure the average number of days a company takes to collect revenue after sales. A low DSO means it takes fewer days to collect its accounts receivables and vice-versa.

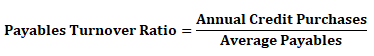

3. Payables Turnover Ratio:

A short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. If the turnover ratio is falling from one period to another, this is a sign that the company is taking longer to pay off its suppliers than it was before. The opposite is true when the turnover ratio is increasing which means that the company is paying off suppliers at a faster rate.

A payables turnover ratio that is high relative to the industry could indicate that the company is not making full use of available credit facilities, alternatively it could result from a company taking advantage of early payment discounts. An excessively low turnover ratio could indicate troublemaking payments on time or alternatively, exploitation of lenient supplier terms.

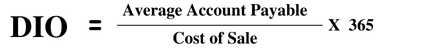

4. Days Payable Outstanding (DPO):

DPO is calculated to see how long a company will take to pay back its trade creditors. It reflects the average number of days the company takes to pay its suppliers. A higher ratio implies that the company takes longer time to pay their bills to the suppliers. This means they can retain the funds for longer duration and utilise those funds in the most efficient manner. However, a higher ratio would also hurt the company’s reputation and would imply inability to pay bills on time. Suppliers and creditors may also refuse to extend trade credit in future to the company. Additionally, the company may also lose on any discount on timely or early payments and may end up paying more.

5. Inventory Turnover Ratio:

It is the measure of a firm's efficiency with respect to its processing and inventory management. This ratio shows how many times a company's inventory is sold and replaced over a period. It indicates the resources tied up in inventory.

A low turnover relative to industry norms implies poor sales and therefore, excess inventory. It is an indicator of slow-moving inventory perhaps due to technological obsolescence or a change in demand. A high ratio relative to industry norms imply either strong sales or ineffective buying. It can indicate highly effective inventory management. Alternatively, it can also indicate inadequate inventory so that the shortage could potentially hurt revenue.

This ratio should be compared against industry benchmarks and is very important for the retail industry where inventory management is one of the key tasks of the management.

6. Days Inventory Outstanding (DI0):

It is a financial measure of a company's performance that gives investors an idea of how long it takes a company to convert its inventory into sales. The lower the DIO, the better it is. A low DIO implies that cash is tied up in inventory for a shorter period and lower the risk of obsolescence. A high DIO implies that the company’s cash is tied up in inventory for a longer period, meaning it cannot be deployed for other purposes. A high DIO may also be associated with overstocking, leading to higher than necessary storage costs and a high level of obsolete stock that may never be sold. It is important to note that the average DIO differs from industry to industry.

7. Cash Conversion Cycle (CCC):

CCC = DIO + DSO – DPO

The Cash Conversion Cycle measures the time each net input is tied up in the production and sales process before it is converted into cash through sales to customers. It measures the length of the time required by a company to go from cash paid to cash received. The cycle looks at the amount of time needed to sell inventory, the amount of time needed to collect receivables and the length of time the company is affordable to pay its bills without incurring penalties.

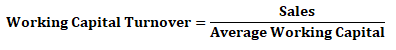

8. Working Capital Turnover Ratio:

The working capital turnover ratio is used to analyze the relationship between the money used to fund operations and the sales generated from these operations.

Some firms may have very low working capital if outstanding payables equals to or exceeds inventory and receivables.

In a general sense the higher the working capital turnover, the better because it means that the company is generating a lot of sales compared to the money it uses to fund the sales, indicating greater efficiency. Companies like HUL and ITC have been known to create shareholder wealth because of a very high working capital turnover ratio. They block very little or zero capital in working capital and generate very high turnover.

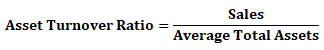

9. Asset Turnover Ratio:

This ratio measures the effectiveness with which a firm uses its total assets to generate revenue.

Different businesses have different turnover ratios. A manufacturing business that is capital intensive might have an asset turnover ratio close to one while a retailer might have a turnover ratio close to ten.

It is desirable that a firm's asset turnover is close to industry norm. A low ratio indicates that a company has too much capital tied up in its asset base and a ratio too high might imply that the firm has too few assets for potential sales or that the asset base is outdated.

Let’s calculate turnover ratios from the information given above: -

1) Receivables Turnover Ratio = Sales/Average Receivables = 50,000/2,900 = 17.24

[Average Receivables = (3,200+2,600)/2 = 2,900]

2) Days Sales Outstanding = 365/Receivables Turnover Ratio = 365/17.24 = 21.17

3) Payables Turnover Ratio = Purchases/Average Payables = 30,000/2,100 = 14.29

[Purchases = COGS + Opening Inventory – Closing Inventory = 30,000 + 3,000 – 3,000 = 30,0000

Average Payables = (2,200 + 2,100)/2 = 2,100]

4) Days Payable Outstanding = 365/Payables Turnover Ratio = 365/7.32 = 25.5

5) Inventory Turnover Ratio = COGS/Average Inventory = 30,000/3,000 = 10

[Average Inventory = (3,000 + 3,000)/2 = 3,000]

6) Days Inventory Outstanding = 365/Inventory Turnover Ratio = 365/10 = 36.5

7) Cash Conversion Cycle = DIO+DSO– DPO = 36.5 + 21.17 – 25.5 = 32.17

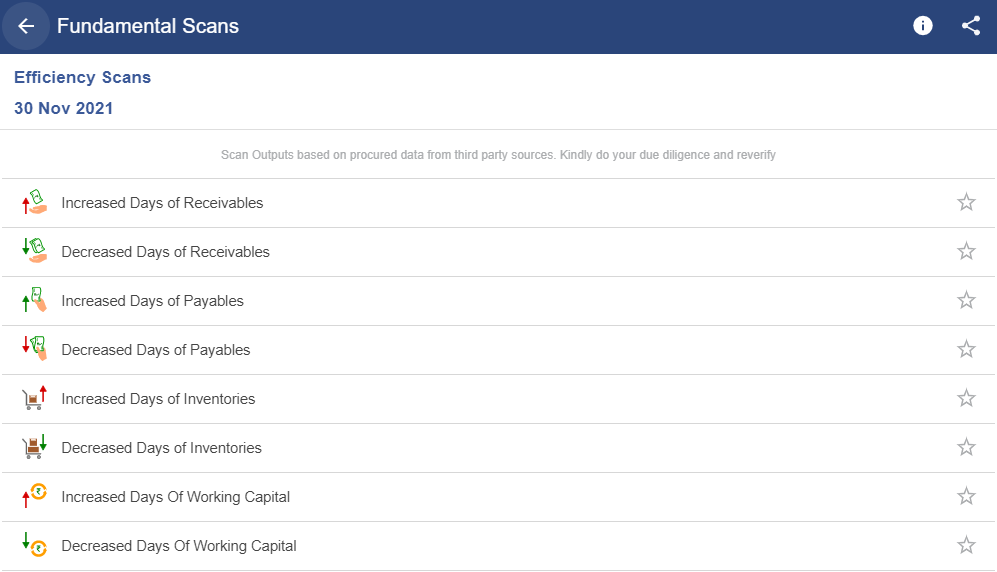

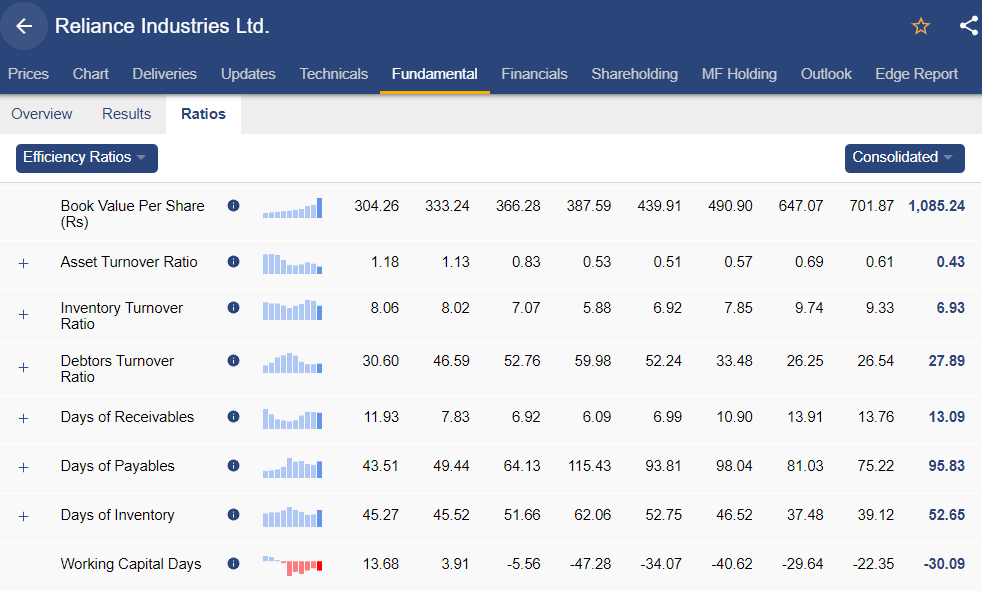

Click here to check out various efficiency scans one can use while comparing various stocks.