Equity Linked Savings Scheme

Another very popular tax saving option, Equity Linked Savings Schemes or more commonly ELSS are basically mutual funds with a lock-in of 3 years. The lock-in period being the lowest among all the tax savings schemes makes it a very popular option among taxpayers in India.

Investment in ELSS is tax-deductible under section 80C. However, bear in mind, the maximum amount is ₹1.5 lakhs.

As the name suggests, a large part of the investment is made in equity. Investment can be made as both lump sum and systematic investment plans (SIP). In case the investment is made through the SIP route, the 3-year lock-in will be applicable from the date of installment payment.

For example, in the case of a monthly SIP of ₹ 10,000, every month starting from 1st April 2022, the installment paid on 1st April 2022 is eligible for withdrawal after 1st April 2025, while the installment made on 1st May 2022 is eligible for withdrawal after 1st May 2025.

These are equity-oriented mutual funds that invest a minimum of 60% in equity and equity-linked instruments. The mandatory lock-in helps the fund to grow and helps the investor earn a sizable return.

ELSS can be open-ended or close-ended. Often towards the end of the financial year, mutual fund houses launch ELSS schemes with fixed lock-in periods that remain open for only a certain period. Once the investment period gets over, no further investment can be done till the end of the lock-in period.

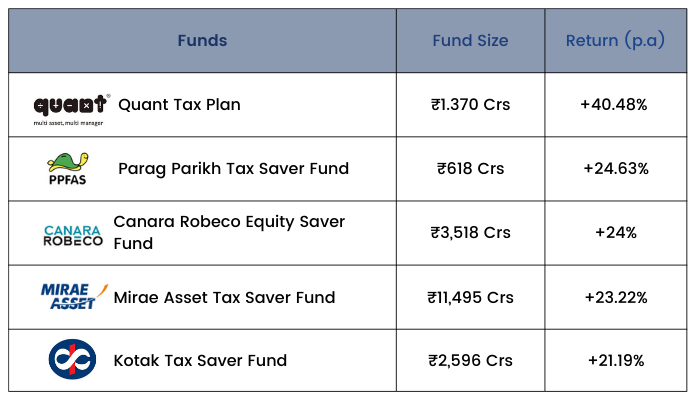

Now, let us take a look at the returns of some of the ELSS funds available in the market at present. For the benefit of the reader, we have listed only open-ended ELSS schemes where investment can be made by anyone at any time during the year.

Data as on 8th Aug 2022 (3 years return)