Public Provident Fund

One of the most popular tax savings schemes for decades, Public Provident Funds (PPF) offer deduction under section 80C. The maximum amount eligible for deduction is ₹1.5 lakhs. One can open PPF in banks or post offices.

The main reason for the popularity of PPF is that it falls under the exempt-exempt-exempt category. As we mentioned earlier, the investment is deductible under section 80C. The interest and maturity are also exempt from tax.

PPF accounts have a lock-in period of 15 years. On maturity, the investor is given two options – either to withdraw the proceeds from the account or continue for any number of years for a block of 5 years.

Here are some of the things to note about PPF investments:

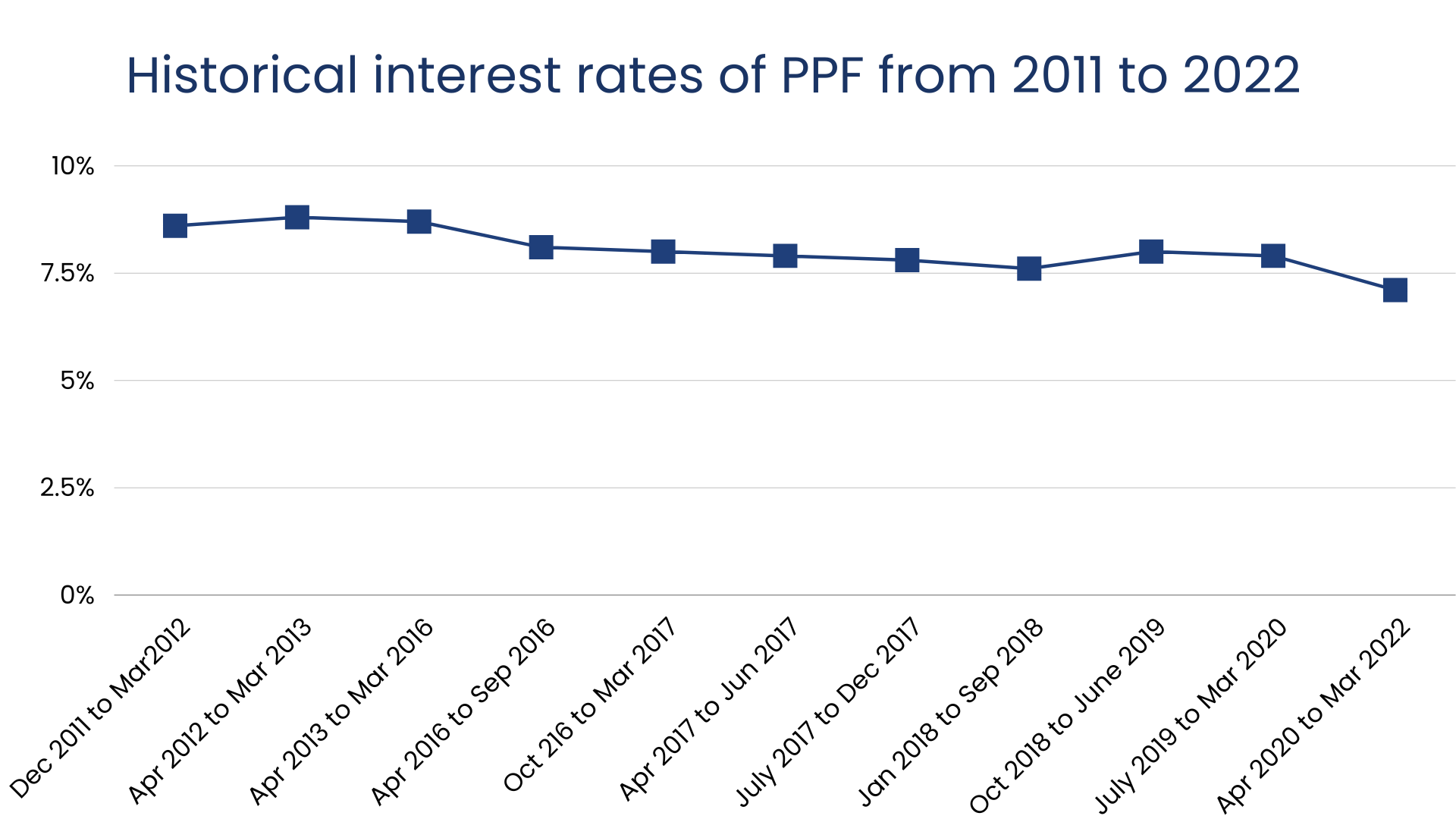

Now let us come to the question that must have been hovering in your mind – what about the interest rate?

As we all know, the interest rate is announced by the government from time to time. The PPF interest rate for Q2 (July-September) FY 2022-23 is 7.1%.

Here’s a graphical representation of the PPF interest rates from 2011 to 2022: