Senior citizen savings scheme

As the name suggests, a senior citizen savings scheme is available to all citizens of India who are aged 60 years & above. They can invest in this scheme through banks and post offices. This is a government-backed retirement benefits program where senior citizens can invest a lump sum individually or jointly and obtain regular income along with tax benefits.

The minimum amount of investment is ₹1000 and multiples thereof. The maximum that can be invested in a single installment is ₹15 lakhs. In this scheme, the deposits mature after a period of 5-years. However, the depositors can extend the maturity period by another 3-years.

The investment qualifies for deduction under section 80C of the Income Tax Act up to ₹150,000. However, please note that the interest is fully taxable and is liable for a tax deduction if the interest is above ₹50,000. The interest compounds and is paid out annually.

Who can open a senior citizen savings scheme account?

- Individuals aged 60 years and above.

- Individuals aged below 60 years but above 55 years who have retired on superannuation.

- Individuals aged 55 years and have retired before the implementation of this scheme.

- Retired Defence Services personnel, irrespective of their age. However, they have to meet certain criteria.

- HUF and NRIs are not eligible to open a senior citizen savings scheme account.

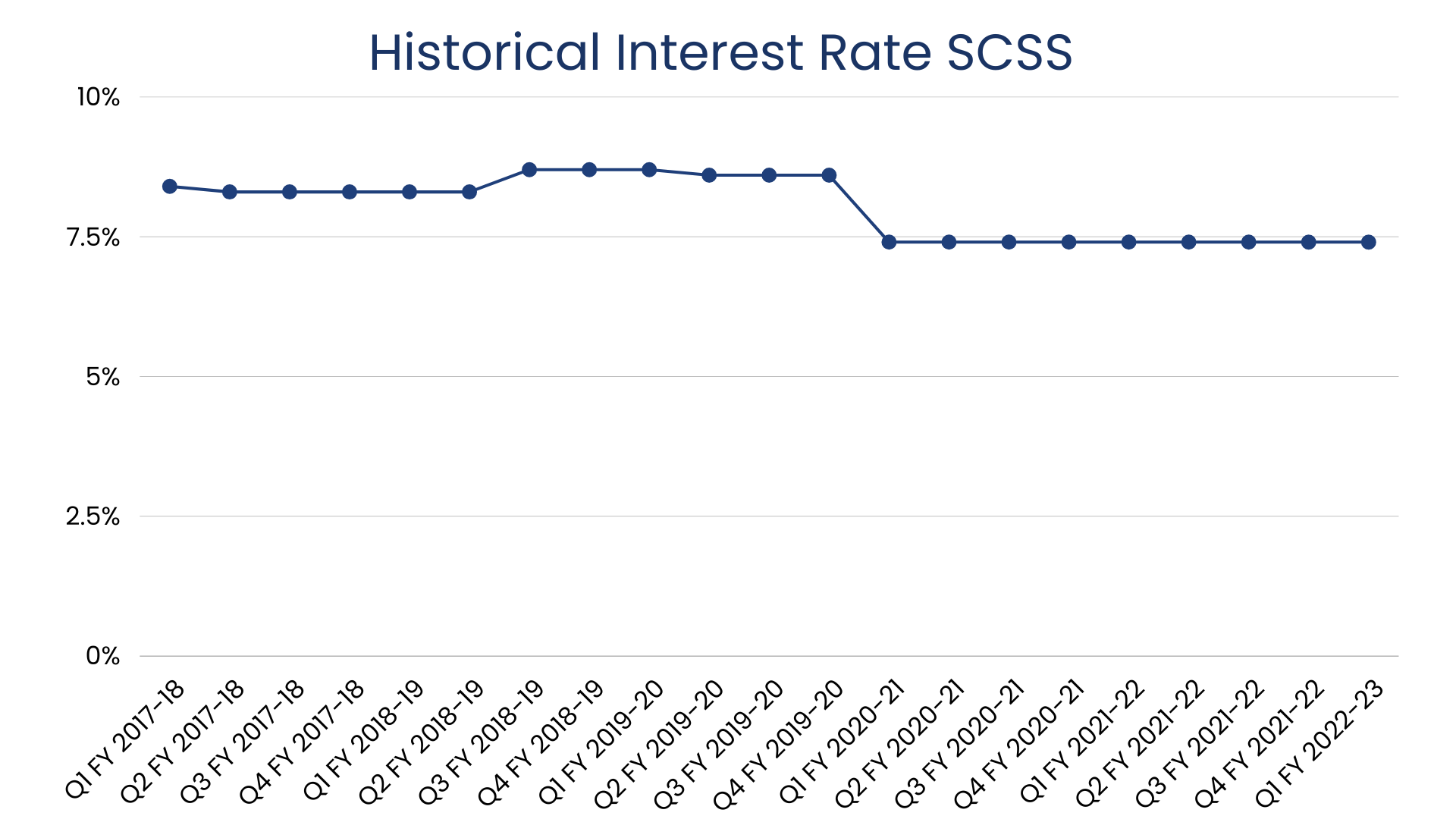

The graph below shows the historical movement of the interest rate of the senior citizen savings scheme: