Amortization

Amortization is similar to depreciation that we learned in the last section. We have learned depreciation is the loss in value of tangible assets, whereas amortization is the loss in value of intangible assets. So, let us understand the concept of amortization.

What is Amortization?

Amortization is a method of allocating the cost of an intangible asset over its useful life.

Amortization is a non-cash item.

We amortize finite life intangibles like -

- Patents, slogans

- Capitalized software

- Deferred financing fees

For example, if Adani Group of Industries purchases software for its operational usage for ₹12 million, every accounting year, the company will expense ₹100,000 as amortization expense for 12 years, because software is an intangible asset.

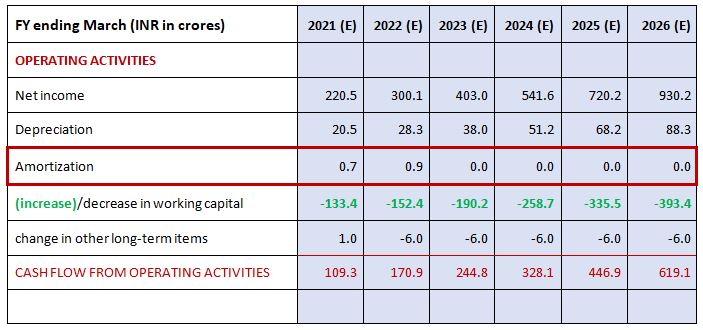

Amortization expenses can be forecasted in several ways. The above shown is just one of the ways of forecasting amortization expenses.

Amortization & Cash-Flow Statement

Amortization is a non-cash expense.

Indirect cash-flow statements start with net income. Net income includes amortization expense.

Hence amortization expense is added back to the Net Income to calculate the Operating Cash Flow.

Adding Back Amortization

Amortization & Income Statement

Amortization expense in linked to the income statement below the EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) to calculate EBIT (Earnings before Interest and Taxes)

Linking Amortization to P&L

Linking Intangibles to Balance Sheet

The ending tangibles which we get from the Amortization Schedule is then linked to the Balance Sheet.