Debt and Interest

Debt & Interest are also an important part of a financial model. So let us discuss both of them in this unit.

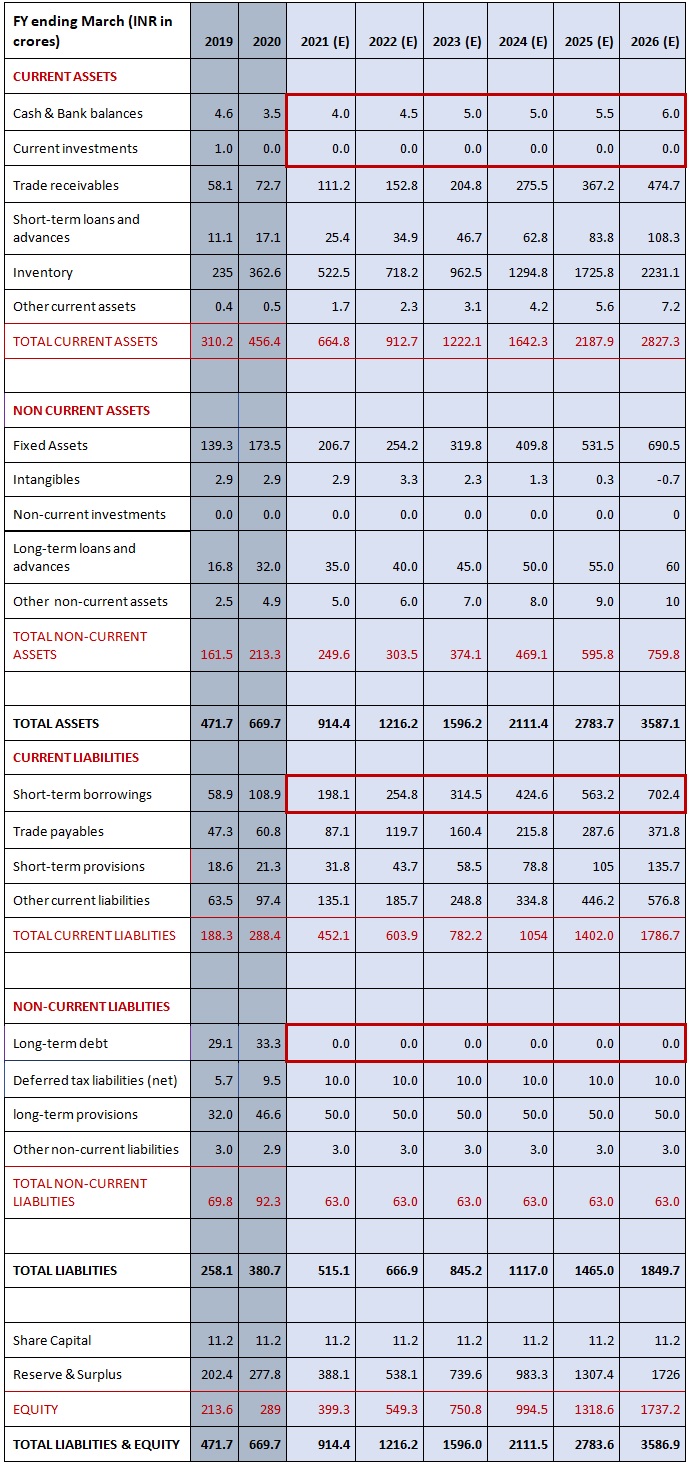

Debt and interest Schedule (Part A)

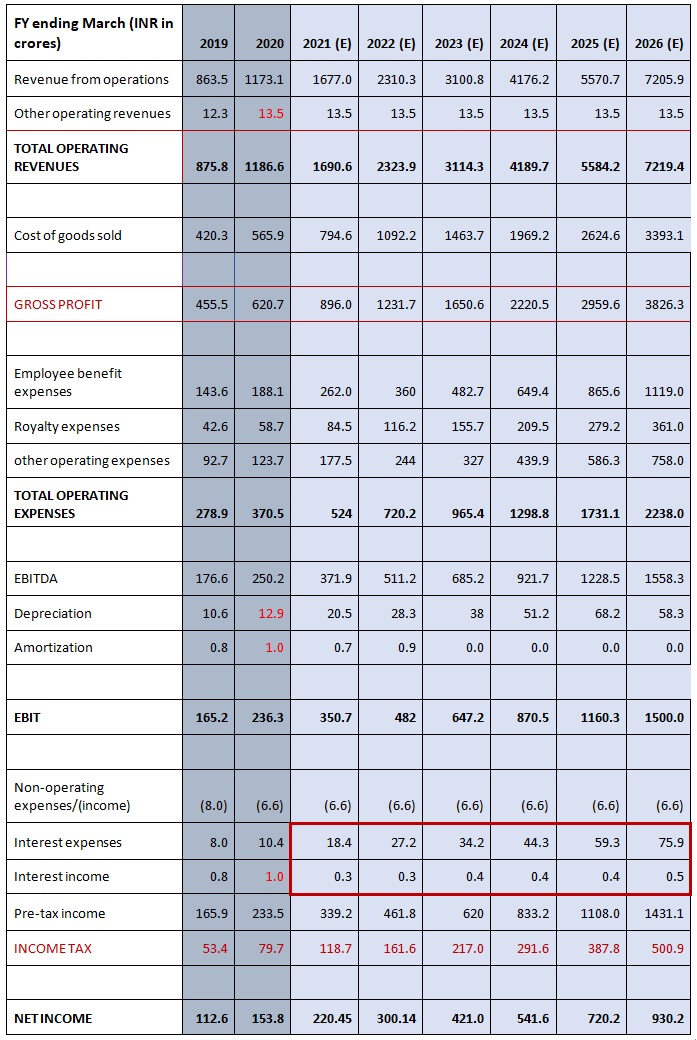

Debt and interest Schedule (Part B)

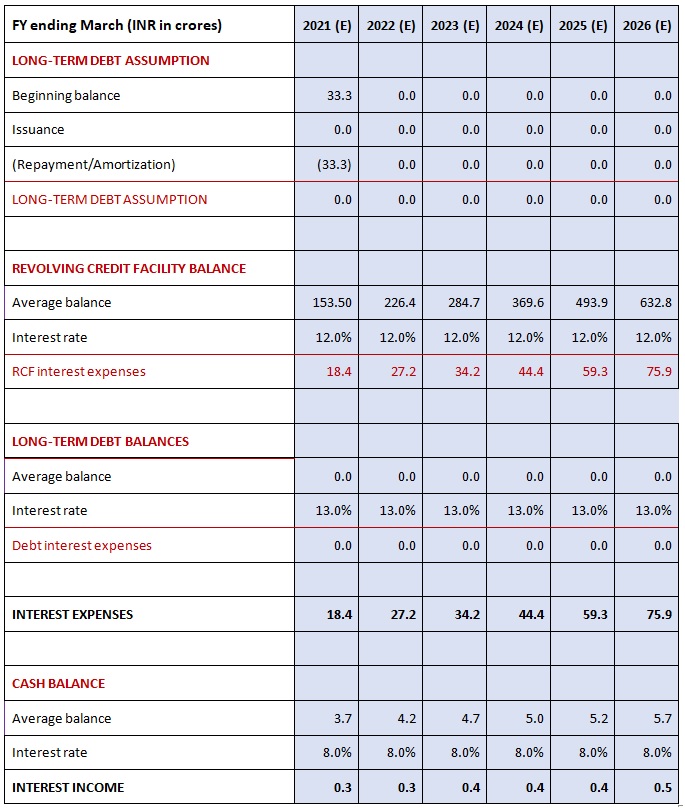

Average Balance = 0.5 (Beginning Balance + Ending Balance)

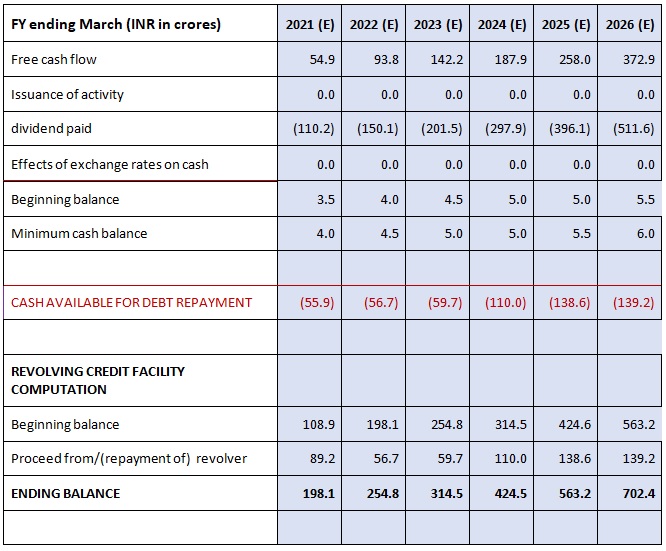

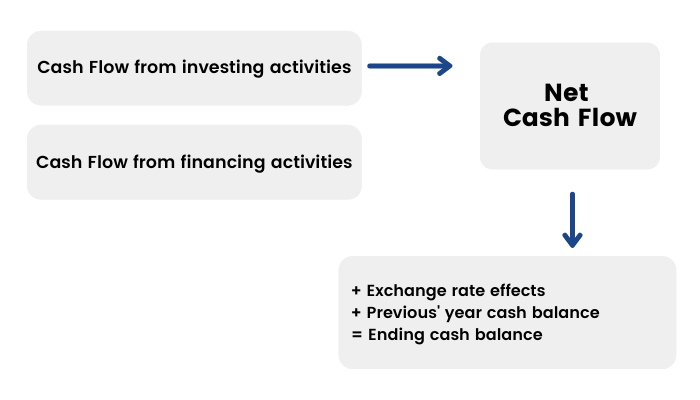

Progression of the Cash Flow

Preparing for Debt and Interest

a)Income statement: missing interest expense / (income)

b)Balance sheet: missing cash and debt items

c)Cash-flow statement:

- Calculate cash flow from operating and investing activities.

- Calculate cash flow available for financing activities.

- Calculate ending cash balance.

- Link with balance sheet.

- Cash flow from operating activities

Steps

Link net income to the cash flow statement.

d)Calculate CFO, CFI, and CFF.

e)Calculate CFF and net change in cash.

f)Reference beginning cash balance from the balance sheet and calculate ending cash balance.

g)Link ending cash balance to the balance sheet.

Debt and Interest (Overview)

Cash Flow available for debt repayment

Long term:

a)Reference in historical balances

b)Enter mandatory long-term debt repayments

c)Calculate projected long-term balances

Calculate – Cash flow available for revolver

Revolver = Cash sweep

Cash sweep refers to using the company’s excess cash flows to pay off the debts.

Calculate interest expense / (income)

- Based on average balances

- Revolver interest expense

- Long-term debt interest expense

- Cash balances for interest (income)

Linking Debt Schedule

Link:

- Projected interest expense / (income) to income statement

- Projected debt repayments / borrowing to cash flow statement

- Projected debt balances to the balance sheet

Debt Schedule & Cash-Flow

The highlighted region comes from the Equity schedule.

Debt Schedule & Balance Sheet