Building a Personal Financial Model

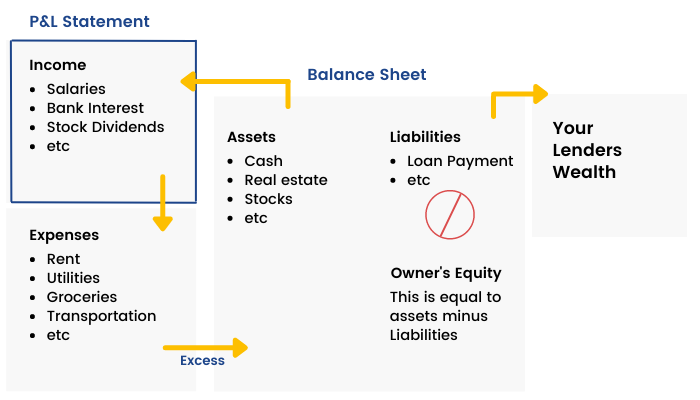

Let us start with preparing a financial model based on personal finance.

Personal Finance is all about handling and managing your own money – be it income, expenses, savings, investments, insurance, etc. A Financial Model can help an individual to analyse his personal financial situation by representing it in a spreadsheet.

The four important pillars of a personal finance model are –

- How much money comes in?

- How much money goes out?

- What do you own?

- What do you owe?

The major areas of Personal Finance can be divided into following parts –

1)Income

Income refers to the source of cash inflow for an individual. It includes Wages, Salaries, Dividend, Incentives, Bonus, Pensions, etc. This income can be spent to purchase essential and luxury commodities. It can also be used for savings and investment purposes. It is the first step in the Personal Finance Model.

2)Spending

It refers to the expenses incurred on buying goods or services. The common sources of spending are – rent, food, education, taxes, clothes, entertainment, etc. It is very important to manage one’s expenditure. If expenses are greater than the income, it may cause a deficit leading to borrowing of funds. Hence, managing expenses is a crucial part of the 'Personal Finance Model.'

3)Savings

Savings refers to excess income over spending that is kept aside. The surplus between income and spending can be either saved or invested. The most common ways of keeping one’s savings are – Physical cash, Savings Account, etc. Individuals are advised to keep some money as savings to meet any short-term contingency. However, too much savings can lead to forgoing of high probable returns that could have been earned if the money was invested.

4)Investment

Investment refers to purchasing of assets that are expected to generate a rate of return. It carries with itself an element of risk. Some forms of investments are Stocks, Bonds, Mutual funds, Real estate, Commodities, etc. There are different types of investment with various risk and return characteristics. Hence, it is very crucial to plan this.

5)Insurance

Insurance is an agreement wherein a party (insurer) provides financial protection to another party (insured) in case of contingent, unforeseen, adverse event in future in return of premium. Various types of insurance include – Life Insurance, Health Insurance, General Insurance, etc.