Bank Fixed Deposit

As discussed earlier, we can simply deposit our money in a savings bank account to earn a nominal interest on our money. It offers the highest liquidity. But what if we want a higher rate of interest on our money? Is there any kind of banking products available? Yes, of course, these are called bank deposits. It can be a fixed deposit or a recurring deposit. In this section, we will learn about fixed deposits, and in the following unit, we will discuss recurring deposits. So, let us start:

What is a Fixed Deposit?

A fixed deposit is an instrument which gives a higher rate of interest than a savings account, but the deposit has to be for a specified time period, for example, 7 days, 1 year, 2 years and so on. In India, a Fixed Deposit can be made for a maximum of 10 years. For fixed deposits greater than 1 year, interest is compounded quarterly. People are attracted towards fixed deposits because they offer fixed returns. The interest rate is fixed in the beginning as per the terms and conditions of a particular bank and is valid till maturity of the fixed deposit.

Types of Bank Fixed Deposit

Depending on the need, one can opt for a normal fixed deposit wherein a certain deposit is made at a fixed interest rate which holds till maturity, or one can opt for tax saver fixed deposits wherein the deposit has a lock in period of 5 years. In case of a Tax Saver FD, the deposit cannot be liquidated before 5 years. Senior Citizens are offered higher interest rates as compared to normal individuals. A normal fixed deposit can be pre-matured, but after paying a penalty.

How to Open a Fixed Deposit Account

The following documents are required to open a Fixed Deposit account:

- Duly filled Application Form with a photograph

- Age Proof (PAN Card, Passport, Any other Certificate from Statutory Authority)

- PAN Card

- Residence Proof (Passport, Driving License, Telephone Bill, Ration Card, Election Card, Any other Certificate from Statutory Authority)

It is not necessary to have a savings account in the same bank where the FD has been opened if it is booked in interest compounding mode. But it is required to have a savings bank account in the same bank where one has booked a fixed deposit if one wants to receive interest payout credited in savings bank account. The Fixed Deposit can be opened either by filling a form online or by visiting the bank branch.

Interest Rate Mechanism

For Fixed Deposits interest can be compounded monthly, quarterly or annually. The present rate of interest is between 6.5% and 7.5%.

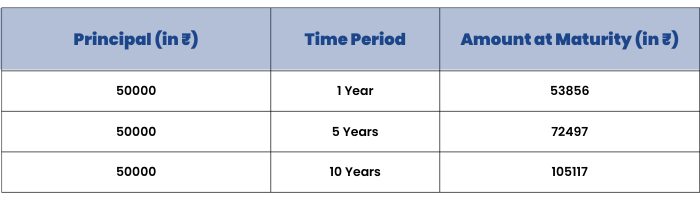

For example, we take the interest rate as 7.5% compounded quarterly. The following table shows what would be the amount receivable at maturity if we invest ₹50000 for different time periods:

Tax Implications

The Principal of Tax Saver Fixed Deposit is eligible for deduction under Section 80C. However, interest earned from them is taxable. If interest earned is greater than ₹10,000, it would be liable to taxation. These days, if interest earned is greater than ₹10,000, the tax is deducted at source (called TDS) and the rest of the amount is transferred to the holder’s account.

Risk associated with Fixed Deposit

If linked to the savings bank account, the fixed deposits are counted as a part of savings capital, hence, on the whole, the amount is protected up to ₹5 lakhs by the Deposit Insurance and Credit Guarantee Scheme of India (DICGC). If inflation turns out to be higher than the nominal interest rate of the Fixed Deposit, there would be no real returns available. Hence, it is not inflation protected.