Recurring Deposit Account

Let us now talk about Recurring Deposits; what are they? How can you open such accounts? What are its benefits?

What is a Recurring Deposit Account?

It is similar to fixed deposits that we have learned previously. Instead of fixing a lump sum amount at once, in a recurring deposit account an individual can deposit any amount each month for a predetermined period and earn a fixed interest on the deposits. A minimum period for RD is 6 months and maximum is 10 years. The interest rate for recurring deposits is a bit lesser than that offered to fixed deposits. A recurring deposit has a lock-in period, but, it can be pre-matured after paying a penalty. Recurring Deposit is a good way to enable forced saving.

How to Open a Recurring Deposit Account?

The following documents are required to open a Recurring Deposit account:

- Duly filled Application Form with a photograph

- Age Proof (PAN Card, Passport, Any other Certificate from Statutory Authority)

- PAN Card

- Residence Proof (Passport, Driving License, Telephone Bill, Ration Card, Election Card, Any other Certificate from Statutory Authority)

It is not necessary to have a savings account in the same bank where the RD account has been opened. But, it is beneficial to start a Recurring Deposit in the bank where one holds a savings bank account. Then, the Recurring Deposit can be opened either by filling a form online or by visiting the bank branch.

Interest Rate Mechanism

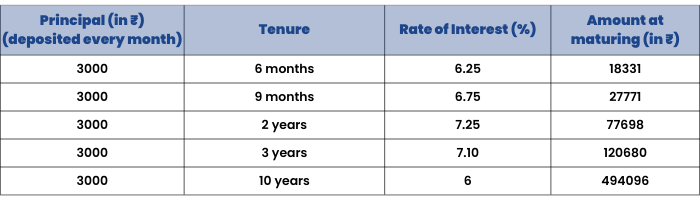

For Recurring Deposits, interest is compounded quarterly. The present rate of interest is between 6% and 7.25% p.a. For senior citizens, the interest rate is between 6.75% and 7.75%. Recurring Deposit interest rates vary according to the tenure of deposit.

We see the table below for some comparisons:

Tax Implications

There is no tax relief for Recurring Deposits. If interest earned is greater than ₹10000, the tax is deducted at source (called TDS) and the rest of the amount is transferred to the holder’s account.

Risk associated with Recurring Deposit

If linked to the savings bank account, the recurring deposits are counted as a part of savings capital, hence, on the whole, the amount is protected up to ₹5 lakhs by the Deposit Insurance and Credit Guarantee Scheme of India (DICGC). If inflation turns out to be higher than the nominal interest rate of the Recurring Deposit, there would be no real returns available. Hence, it is not inflation protected.