Post Office Time Deposit

It is similar to a bank fixed deposit, but it gives a marginally higher rate of interest than a bank fixed deposit. A post office FD can be made for a period ranging from 1 year to 5 years. The minimum amount for this FD is ₹200 and there is no maximum amount. The interest rate is fixed at the beginning of the FD and holds till maturity. A Post Office fixed deposit can be pre-matured, but after paying a penalty.

How to Open a Post Office Fixed Deposit Account?

The following documents are required to open a Fixed Deposit account:

- A deposit opening form provided by the post office

- Address and identity proof such as copy of the Passport, PAN (permanent account number) card or declaration in form No 60 or 61 as per the Income Tax Act 1961, Driving license, Aadhaar Card, voter's ID or ration card

- One must carry original identity proof for verification at the time of account opening

- Choose a nominee and get a witness signature to complete the formalities to start the deposit

It is not necessary to have a savings account in the same post office where the FD account has been opened.

Interest Rate Mechanism

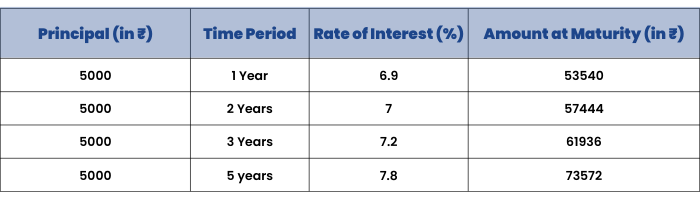

For Fixed Deposits interest is payable annually but calculated quarterly. The interest rate ranges from 6.9%-7.8% p.a. for one year to five-year FD's. The interest rate is linked to G-Sec rates. The interest rate is subject to change as and when G-Sec rates change, but once a Fixed Deposit is booked, the interest rate prevailing at the time of booking the Fixed Deposit would hold till maturity.

The following table shows what would be the amount receivable at maturity if we invest ₹50000 for different time periods:

Tax Implications

The principal amount of a Five-Year Fixed Deposit is eligible for deduction Section 80C. However, interest earned from the deposit is taxable. If interest earned is greater than ₹10000, it would be liable to taxation, meaning TDS will be deducted but there is an exemption limit of up to ₹50000 on the interest earned for senior citizens.

Risk associated with Fixed Deposit

There is no risk involved as these deposits are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the Fixed Deposit, there would be no real returns available. Hence, it is not inflation protected.