How inflation can affect your financial plan?

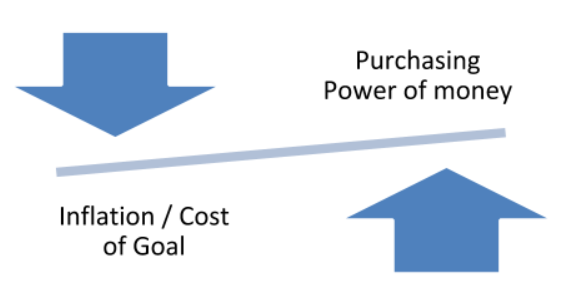

Purchasing power is the quantity of goods or services that one unit of money can buy. For example, Rs.100 can purchase much less today than it could purchase say 20 years ago. If your income level stays the same, but the prices of goods or services increases, then it essentially means that the purchasing power of your income has reduced.

This increase in the price level is called Inflation. Thus inflation is the increase in prices that erodes the purchasing power of your money. And this is the most important factor to account for when making your financial plan.

Example:

Mr. Prajwal Ingle has a 6 year old daughter. He plans to send his daughter to college for graduation at age 18 and post graduation at age 21, for which he will spend 10 lakhs and 25 lakhs respectively.

What corpus does Mr. Prajwal need to accumulate for his daughter’s education goals? Assume that inflation in college fees is approximately 10% p.a.

If Mr. Prajwal’s daughter goes to college at age 18 i.e. in 12 years, college fees at that time will be approximately 31.40 lakhs. This is the amount Mr. Prajwal has to accumulate in 12 years to send his daughter for the same standard of college education available today at 10 lakhs. Similarly, for his daughter’s post graduation, in 15 years Mr. Prajwal needs to accumulate approximately 1.04 crore to give the same level of postgraduate education available for 25 lakhs today. This is the effect inflation has had on college education fees.