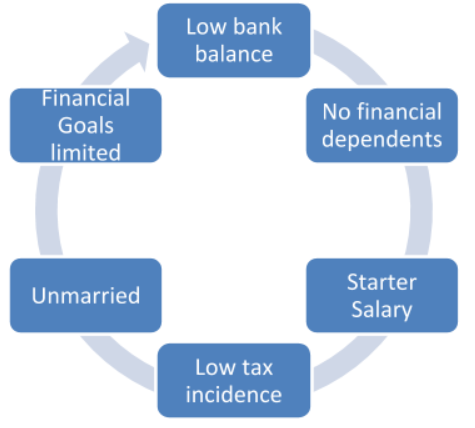

Stage 1 - Your First Job

You’ve graduated and just got your first real job. A critical concern at this time is managing your cash flow.

Start saving

Although you might feel like you don’t have the money, even saving 10% of your income per month is enough to start planning for your retirement. If you’re 23 years old and in your first year of working you manage to save and invest Rs. 24,000 (Rs. 2000 a month for 12 months), then at a growth rate of 15% per annum this Rs. 24000 will grow to Rs. 36.75 lakhs by your age of 60.

Insurance

you most likely have no financial dependents at this time so you might not need life insurance, but you should definitely opt for health insurance. This has dual benefits - firstly, your health is insured and this is most important. Secondly, you can claim a tax deduction of the premium paid, under Section 80D.

Tax Efficient Investment

If your salary brings you into the 5% or 20% tax bracket, the first thing you should do is avail of Section 80C deductions - invest into an ELSS fund (equity exposure) and into your PPF / EPF account (debt exposure). The limit is Rs. 1.50 lakh under Section 80C.

Contingency Fund

Start building up a contingency fund for use only in case of emergencies. Typically this should be the equivalent of 6 to 12 months of your monthly expenses - depending on your personal risk appetite. Set this aside into a liquid mutual fund to earn a better rate of return than your savings bank account. But remember that the aim of this fund is to enable liquidity of money and not just high returns.

If any equity investments are done at this stage and held for a long period like 5 – 10 years or even more would most likely generate a high rate of return, and therefore beat inflation. At this stage of life, equity can be taken for the long run.