What is an EMI and how are EMIs calculated?

The Equated Monthly Installment, or the EMI, is the amount of money paid by borrowers, each calendar month, to the lender, for clearing their outstanding loan. Generally, EMI payments are made every month on a fixed date, for the entire tenure of the loan, till the entire outstanding amount has been completely repaid. The EMI depends on the loan amount, the rate of interest and the duration or the time of repayment of loan.

Home loan providers offer different varieties of loans that are designed to fulfill the diverse needs of home buyers. But, before opting for the right one, it is important to understand the most integral part of any loan, and that is EMI. So, let us understand the composition and how is EMI calculated?

The Components of Equated Monthly Installment (EMI)

When the loan starts, the interest component is very large, and the principal component is very small. Every month, the interest component becomes lower than the previous month, and the principal component becomes higher than the previous month.

As the loan matures, and as the principal gets paid, the outstanding loan amount reduces.

The EMI is an unequal combination of the principal and the interest.

The EMI amount is a fixed amount each month, except in the following cases:

When the borrower prepays a part of the loan, the lump-sum amount prepaid gets adjusted against the outstanding principal balance, thereby reducing the EMI. The borrower in this case also has an option of maintaining the EMI while increasing the loan tenure.

If the borrower has opted for a floating rate loan, fluctuations in home loan interest rates during the loan tenure will alter the EMI.

Calculating EMI

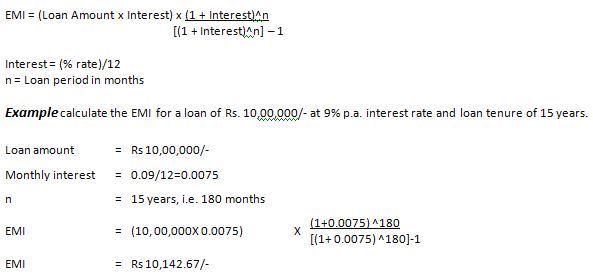

Mathematically, EMI’s are computed using the formula mentioned below.

This EMI of Rs 10,142.67 is a combination of both the interest and principal portion of the loan, to be paid every month.