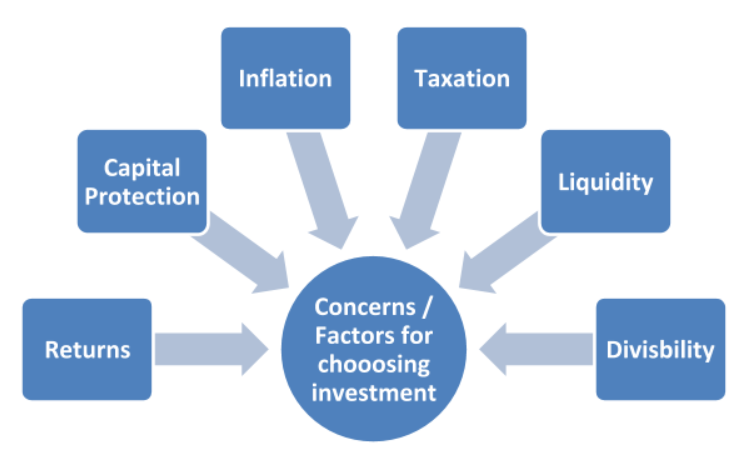

What are the investment concerns that need to be addressed, while investing and choosing the assets?

The most common concerns that needs to be addressed, while investing and choosing the assets are-

Returns

The return from the investment could be in the form of capital gains, cash flows, or both. A retired person might be needing regular cash flows to meet daily expenses, whereas a younger person in the working/accumulation phase might be more concerned with growth of his investment for creating a corpus for his retirement.

Capital Protection

The most important aspect of investment is to protect capital. Majority of Indians are risk averse. We feel investments are risky and thus leave most of our saved money in instruments earning low income, without understanding the effect of inflation, which reduces the value of our money every day.

Risk is part of our lives. There is risk associated with anything or everything we do. Even if we cross a road, there is a risk of meeting with an accident. Risk and reward go hand in hand, higher the risk, more is the reward expected.

Each of the investment assets has its own associated risk and reward/return, which one must understand before investing his money in any of the investment vehicles.

Inflation

By definition, inflation is the rise in the general level of prices of goods and services in an economy over a period of time. When prices rise, each unit of currency buys fewer goods and services, resulting in erosion in the purchasing power of money. The aim of investment is to get returns in order to increase the real value of the money. In other words your investment should be able to beat inflation.

Taxation

Income from our investment assets is liable to taxation, which is going to reduce our returns. You should remember that the real return (read positive return) from any investment product would l be the return after accounting for taxation and inflation.

Liquidity

It is the ability to convert an investment into cash quickly, without the loss of a significant amount of the value of the investment. If you would need a particular amount at a short notice then invest in an investment product with high liquidity.

Divisibility

This is the ability to convert part of the investment asset into cash, without liquidating the whole of the asset. Divisibility may be an important consideration for many investors, while choosing an investment vehicle. For example, while investing Rs. 15 lacs in senior citizen scheme, one could increase the divisibility without affecting returns by dividing this investment in ticket size of Rs. 2-3 lacs, rather than investing Rs.15 lacs in one go.

Before committing your capital to any investment vehicle, it is preferable to consider your financial needs, goals, and aspirations, as well as the risk profile.

What are the avenues for investments?

The various avenues where you can park your saved money are known as ‘assets ‘. In layman’s language or ‘asset class’ in investment parlance. Broadly there are four asset classes in India – equity, debt, gold and cash.

What are the various types of Assets?

- Financial Assets – cash, debt , equity

- Physical / Non-Financial Assets – commodities , real estate

- Alternative Assets – art objects, collectibles , precious stones and Gold,