Leading Vs Lagging Indicators

There are two main types of Indicators:

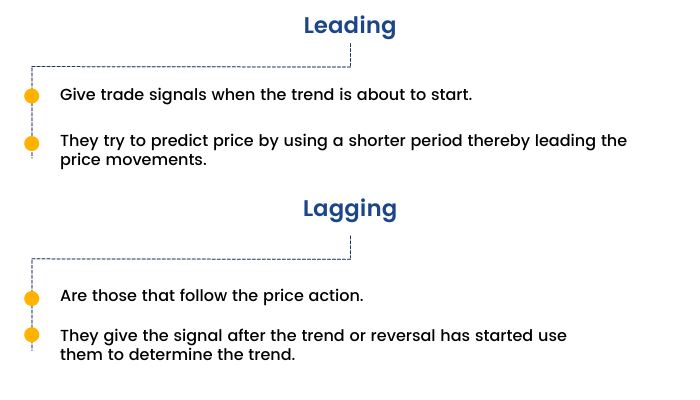

1. Leading Indicators:

A leading Indicator precedes price movements, giving them a predictive quality. It is thought to be the strongest during periods of sideways or non-trending trading ranges. A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market movements ahead of time.

2. Lagging Indicators:

A lagging Indicator is a confirmation tool because it follows price movement. It is still useful during trending periods. It follows an event. These indicators work well when the prices are moving in long trends. They don’t signal upcoming changes in prices but simply tell whether the prices are increasing or decreasing. Many people prefer to choose lagging indicators as it helps them to trade with more confidence by validating their results.

Moving Averages and Moving Average Convergence and Divergence (MACD) are examples of lagging indicators.We will discuss more on Moving averages and MACD technical indicators going forward in this module.

The most obvious difference is that leading indicators predict market movements, while lagging indicators confirm trends. Both leading and lagging indicators have their own pros and cons so it is important for you to decide which indicator to use according to the strategy.