RSI Vs CCI

In our previous units, we have learned two technical indicators RSI and CCI. Here in this section, let us discuss the differences between the two and find out which one is better.

Which is better: Relative Strength Index (RSI) or Commodity Channel Index (CCI)?

Relative Strength Indicator (RSI) is a type of technical indicator which is used as a momentum indicator. It is used to compare the magnitude of recent gains and losses over a specified time period to measure speed and change of price movements of a security.

The Commodity Channel Index (CCI) is a momentum based technical trading tool used most often to help determine when an investment vehicle is reaching a condition of being overbought and oversold.

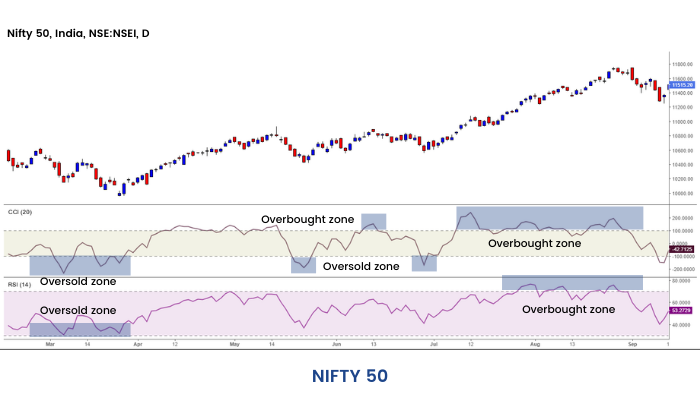

Commodity Channel Index (CCI) and Relative Strength Index (RSI) are both Momentum Indicators which shows oversold and overbought regions.

The default setting of RSI is 14 while the default setting of CCI is 20. CCI shows the overbought and oversold regions more often as compared to RSI.

This NSE daily chart shows us that CCI is indicating more overbought and oversold regions as compared to RSI.